Xeneta News

The prospect of a large-scale return of container ships to the Red Sea following the announcement of a ceasefire between the US and Houthi militia in Yemen would flood the market with shipping capacity and cause a global collapse in freight rates – but the situation remains far from certain. Data released by Xeneta – the ocean and air freight intelligence platform – shows global TEU-mile demand would decrease 6% if container ships begin sailing through the Red Sea and Suez Can...

Xeneta has launched an index-linked contract (ILC) simulator to help shippers navigate ocean freight container market volatility and end procurement inefficiency. The new ILC Simulator – now available in the Xeneta platform – allows shippers to compare traditional fixed-rate contracts with index-linked contracts using sample corridor data or their own historical ocean container freight rates. Shippers and logistics services The simulator is an important first step towards index-li...

Middle East ceasefire and Lunar New Year will see ocean container freight rates fall further in February - with carriers now taking action to slow the market decline. Latest data from Xeneta – the ocean and air freight intelligence platform – shows average spot rates from the Far East stand at USD 3 795 per FEU (40ft container) into North Europe and USD 5 085 per FEU into the Mediterranean – down 22% and 13% respectively since 1 January. Falling spot rates Early data s...

Strikes at ports on the US East Coast and Gulf Coast, which would have caused an economic and supply chain crisis, have been called off – with ocean container freight rate growth now expected to slow or fall. The strikes were set to begin on 15 January and would have forced the closure of ports from Maine to Texas. This has now been averted after a tentative agreement over a new six-year master contract was reached between the International Longshoremen’s Association (ILA), which re...

Industry pioneers at the Xeneta Summit 2024, in Amsterdam, the Netherlands, have been told ocean container shipping must harness the power of machine learning to protect supply chains in an increasingly complex and volatile market. In a keynote speech to announce Xeneta’s new in-platform Ocean Market Rate Outlook, Chief Product Officer - Fabio Brocca explained how machine learning will transform the way freight is bought and sold by predicting market movements on the world’s major c...

The ocean container shipping market reached a tipping point in July, with long-term rates on major fronthaul trades showing signs of life just as spiraling short-term rates begin to soften. The Xeneta Global XSI®, which covers all valid long-term contracts in the market, edged up 2.5% in July to stand at 151.5 points. XSI® sub-index More notably, the underlying XSI® sub-index for Far East Exports which includes the world’s biggest fronthaul trades to Europe and the US increa...

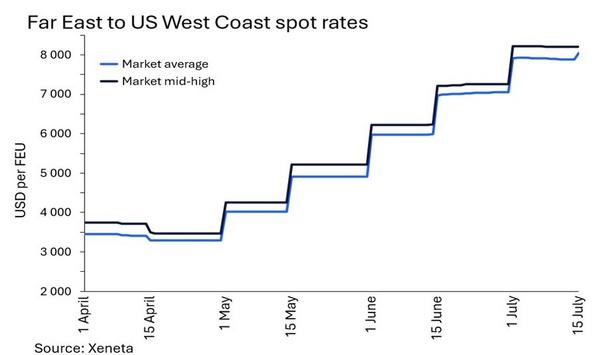

The dramatic spike in the ocean freight container shipping market is reaching its peak as importers push back against spiralling spot rates. Data released by Xeneta shows average spot rates from the Far East to the US East Coast increased by 3.7% on 15 July to stand at USD 10 045 per FEU (40ft equivalent shipping container). Average spot rates On the US West Coast, spot rates increased by 2.0% to stand at USD 8,045 per FEU. While this means spot rates are up almost 150% on these trades sinc...

Ocean freight container carriers are treading a fine line between risk and reward during new contract negotiations as the market remains gripped by uncertainty in the Red Sea, according to new data on the Xeneta Shipping Index (XSI®). The latest data released by Xeneta, on Thursday, shows the Global XSI® (the average rate of all valid long-term contracts in the market) remained fairly flat in April at 154.3 points, up by just 1.7% from March. However, looking at sub-indices within this...

The Francis Scott Key Bridge in Baltimore has collapsed, after it was struck by a container ship at around 1.35 am ET. The container ship involved is the Singapore-flagged Dali which can carry just under 10,000 TEU (20ft shipping containers) and was operating on a 2M alliance service between Baltimore and the Far East. Mass casualty event Emily Stausbøll, Market Analyst at Xeneta – the ocean freight shipping rate benchmarking and intelligence platform, said, “Thi...

The beleaguered carrier industry took another major hit in June, with the latest data from Xeneta’s Shipping Index (XSI®) showing a decline of 9.4% in global long-term shipping rates. Following on the heels of a 27.5% collapse in May, and a 10.3% fall in April, contracted rates have now shed 47.2% of their value in the last three months alone, and 51.7% over the course of 2023. Xeneta’s real-time data, crowd-sourced from pioneering global shippers, shows falls in the prices of...

Analysis of Xeneta’s Carbon Emissions Index (CEI) has revealed that Yang Ming is the container industry’s ‘emission hero’ for all relevant CEI-covered trades in Q4 2022. The Taiwanese giant was the industry’s only major player to score below the CEI performance baseline of 100 (set in Q1 2018) across all CEI routes. According to the Carbon Emissions Index (CEI), a unique solution from Xeneta and Marine Benchmark, Yang Ming found the industry’s best balance be...

HMM announced it was selected as the best-performing carrier, achieving the lowest carbon emission between Far East Asia and the U.S. West Coast in Q4 2022, based on the Carbon Emissions Index (CEI). Carbon Emissions Index (CEI) is published quarterly by Xeneta, a major ocean freight rate analysis firm, in partnership with Marine Benchmark, a data management specialist for the maritime industry. Carbon Emissions Index (CEI) CEI demonstrates the carbon intensity of shipping companies across 13...

Xeneta has taken the first step in a campaign to identify the carrier industry’s best and worst environmental performers across the world’s 13 major shipping trades. With the help of the Carbon Emissions Index (CEI), a unique tool from Xeneta and Marine Benchmark, carriers have been assessed on the main Far East to South America East Coast container corridor. The analysis makes uncomfortable reading for industry giant - Evergreen. Proof of performance In an age of ever-greater env...

Long-term ocean freight rates suffered a steep month-on-month decline in November as subdued spot prices, weak demand, and ongoing economic uncertainty caught up with contracted container agreements. The latest data from the Xeneta Shipping Index (XSI®) indicates that global rates fell by 5.7%, with all major corridors experiencing negative import and export trends. This is the third month in a row that rates have dropped, but the largest month-on-month decline recorded since the launch of...

Xeneta, the globally renowned ocean and air freight rate benchmarking and market analytics platform, and Marine Benchmark, a major provider of information analysis services and tools for the marine industry, have launched the Carbon Emissions Index (CEI) for the container shipping market. Carbon Emissions Index (CEI) The Carbon Emissions Index (CEI) by Xeneta and Marine Benchmark is a first-of-its-kind data solution that tracks and compares the carbon emissions of ocean carriers across 13 main...

The latest ocean freight rate data from Xeneta reveals that spot rates are currently USD 3 700 more expensive for shipping 40’ containers from the Far East to the South American East Coast compared to the West Coast corridor. This huge gap – the norm is usually around a USD 55 East Coast premium – has opened up since 1 July. However, shippers looking to take advantage of the disparity should move quickly, Xeneta warns, as it may begin to narrow across August and September. Si...

While spot rates for ‘dry standard’ FEUs are declining on the world’s key global trading corridors, the rates for equivalent reefers are bucking the trend on the North Europe to Far East route. According to the latest market intelligence from Xeneta, which crowd sources real-time ocean freight rate data from shippers, the average 40’ HC reefer spot rate stood at a mighty US$ 5230 for the trade on 23 August, compared to dry standard FEUs at US$ 980. At this point, two ye...

It’s been another bumper month for long-term contracted ocean freight rates, as the cost of securing container shipments climbed by 10.1% in June 2022. Following on the heels of a record 30.1% hike in May 2022, this now means rates stand 169.8% higher than this time in 2021, with just two months of declines in the last 18 months. Despite a degree of macro-economic uncertainty clouding the horizon, all major trades saw prices moving up, with some corridors showing significant gains. Xenet...

May saw the highest ever monthly increase in long-term contracted ocean freight rates, as the cost of locking in container shipments soared by 30.1%. The unprecedented hike, revealed in the latest Xeneta Shipping Index (XSI®) Public Indices for the contract market, means that long-term rates are now 150.6% up year-on-year. In 2022 alone, costs have climbed by 55%. “This is a staggering development,” comments Xeneta CEO Patrik Berglund. “Just last month we were looking at a...

April 2022 saw the third consecutive monthly climb in long-term contracted ocean freight rates, with shipping costs rocketing by 11.1% globally to stand 109.9% up year-on-year. The data, revealed in the latest Xeneta Shipping Index (XSI) Public Indices for the contract market, demonstrates how supply chain demand, successful carrier strategies and continued COVID-19 disruption in China are coalescing to ‘pile on the pain’ for shippers worldwide. Xeneta Shipping Index (XSI) Xeneta&...

Long-term contracted ocean freight rates climbed by 7% in March, pushing shipping prices up 96.7% year-on-year. The rise, revealed in the latest Xeneta Shipping Index (XSI®) Public Indices for the contract market, further boosts the coffers of leading carriers, with Evergreen the latest name to disclose record annual revenues of USD 17.67bn. However, as Xeneta CEO Patrik Berglund points out, the sustainability of such developments remains to be seen. Onwards and upwards Xeneta’s XSI...

After a rare dip in long-term contracted ocean freight rates in December and January, container shipping costs are rising once again, with a 3.9% increase in February. The development, revealed in the latest Xeneta Shipping Index (XSI®) Public Indices, means rates have risen across 15 of the last 17 months. They currently stand 87.9% up year on year. Furthermore, ongoing congestion, high demand, and a new level of geopolitical angst are unlikely to reverse that trend any time soon. “I...

Long-term contracted ocean freight rates fell by 3.6% in January 2022, according to the latest Xeneta Shipping Index (XSI®) Public Indices. Based on crowd-sourced data from global shippers, the analysis shows the second consecutive monthly rates decline, following a staggering 14 months of consistent increases. As such, despite the dip, contracted rates stand 98.1% up year on year, demonstrating the commanding position carriers continue to occupy in shipping negotiations. Pain and g...

Ocean carriers remain in pole position in negotiations for long-term freight contracts, with high demand, port congestion, and supply chain disruption driving further rate increases. The rise in freight rates According to the Xeneta Shipping Index (XSI®) Public Indices, long-term rates recorded their tenth consecutive month-on-month rise in October, climbing by 2.2%. The indices stand at a colossal 93.1% up year-on-year, with little hope of relief on the horizon for embattled shipper...

Xeneta’s Long-Term XSI Public Indices has revealed yet another monthly hike in long-term ocean freight rates, with global container prices climbing by 3.2%. The development follows a 2.2% increase in August 2021 and an unprecedented 28.1% jump in July 2021, leaving rates now standing 91.5% up year-on-year. What’s more, Oslo-based Xeneta reports there is little evidence to suggest a weakening of market fundamentals – meaning there could be more pain in store for shippers, with...

Oslo-based Xeneta, the ocean freight rate benchmarking and market analytics platform, has revealed a jump in long-term contracted rates for containership operators during May, as 2018 rates expire and new contracts push the index upwards. Global rates Global rates leaped by 11.5% across the month, with US rates for imports climbing by close to 20%" According to the latest XSI® Public Indices report, based on crowd-sourced data covering over 160,000 port-to-port pairings, with 110 million...

Xeneta is utilising its database of over 85 million contracted freight rates to deliver a unique monthly snapshot of long-term rate developments in the container industry. The new Xeneta Shipping Index (XSI™) Public Indices report, provides a detailed overview of the busiest global trade corridors, allowing users to gauge regional developments and track trends for key markets. In June this year Oslo-headquartered Xeneta, the ocean freight rate benchmarking and market intelligence platform...