Finance

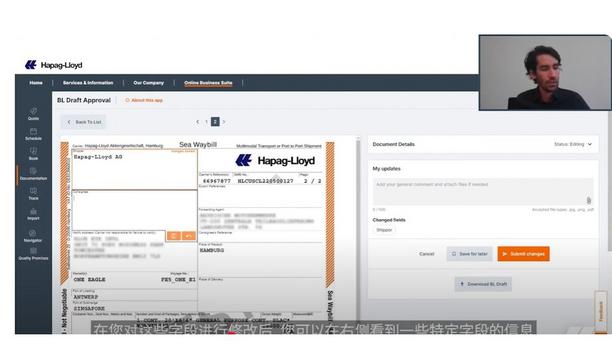

The English Commercial Court (the “Court”) has provided helpful clarity on the extent of damages available to a claimant shipowner for the late redelivery of a vessel under a time charter where there is evidence that the owner of the vessel would have been unable to enter into a subsequent charter for the vessel. In such circumstances, only nominal damages will be recoverable, as no actual loss has been suffered. Background Hapag-Lloyd AG (the “Charterers”) entered i...

Collaboration between countries and sectors needs to strengthen as the North Sea undergoes a period of diversification, according to a new report from DNV. North Sea Forecast: Ocean’s Future to 2050 estimates that offshore wind will claim 9% of the North Sea space by 2050, and policies to promote cross-industry collaboration are required to ease spatial planning pressure. The North Sea hosts Europe’s busiest ports, produces most of Europe’s offshore energy, and is the ar...

Technology group - Wärtsilä is set to expand its state-of-the-art technology centre - Sustainable Technology Hub in Vaasa, Finland, with a €50 million total investment. Expanding the R&D testing capabilities and facilities will enhance Wärtsilä’s ability to meet the growing demand for developing and delivering sustainable technologies in marine and energy and to support fuel applications needed in the future. Smarter engine development Wärtsil&aum...

Fincantieri and Viking announced the first cruise ship in the world to be powered by hydrogen stored onboard for both propulsion and onboard electricity generation, the “Viking Libra”. The vessel is currently under construction at the Fincantieri Ancona shipyard, with delivery scheduled for late 2026. Operating with zero emissions Designed with sustainability in mind, the ship will be capable of navigating and using with zero emissions With a gross tonnage of approximately 5...

Brunvoll expands its product range of tunnel thrusters with its largest thruster to date. This is a response based on trends seen in the cruise industry, where they build larger and larger vessels. The first delivery of this new size is for three cruise vessels, where each vessel will feature four tunnel thrusters. The contract is with an undisclosed shipyard and shipowner. Powerful propulsion Brunvoll’s delivery for the vessels consists of a total 12 tunnel thrusters of the new F...

CIBC Innovation Banking announced that it has provided $10 million in debt financing to Sedna Communications Ltd, an Insight Partners-backed AI-powered workflow automation platform, which specialises in the global trade and supply chain market. The funding will drive AI innovation, expand platform integrations, and support sustainable growth to better serve Sedna’s customers. Maritime and supply chain Founded in 2017, Sedna helps maritime and supply chain businesses extract important da...

News

Achilles, a pioneer in supply chain risk management solutions, and Procureship, the world’s pioneering e-procurement platform, have agreed on a long-term partnership to enhance the ESG capabilities of the shipping industry’s procurement processes. The latest agreement will bring efficiencies to the supply chain assessment and purchasing process for Procureship members. Procureship provides streamlined purchasing for more than 100 fleet owners and operators, including BW LNG, Angelicoussis Group, Oldendorff Carriers, Starbulk Group, TB Marine and Technomar. Benefit from standardised processes Achilles Maritime Network provides a forum for shipowners and chiefs to team By leveraging advanced analytics, machine learning tools, and a unique supplier recommendation engine, Procureship simplifies the procurement process between buyers and suppliers. The Achilles Maritime Network provides a platform for shipowners and managers to collaborate, reduce risks, and enhance supply chain visibility while lowering costs and administrative burdens. Suppliers and contractors benefit from standardised processes and pre-qualification, fostering stronger relationships and business growth. Users of the Procureship platform The network supports transparency, sustainability, and responsible business practices in the maritime industry. Members of the Achilles Maritime Network include BW LNG and LPG, Odfjell, Seapeak and Seasourcing. Through this agreement, users of the Procureship platform can access the Achilles service to improve visibility of their suppliers’ sustainability performance. Procureship will also offer its supplier network the opportunity to demonstrate their Achilles score and standout through a rigorous, independent assessment. Procureship’s supplier profiles Buyers are able to check the suppliers’ Achilles scores on the spot during the evaluation of quotes The Achilles Sustainability Score will be reflected in Procureship’s supplier profiles and displayed in supplier search engine results. Additionally, buyers will be able to check the suppliers’ Achilles scores on the spot during the evaluation of quotations. This will allow maritime purchasers to easily source products from companies that align with their standards, providing greater transparency and confidence in their procurement decisions. ESG module to marketplace services “Procureship identified the need for an ESG module to complement our existing marketplace services and recognised the expertise we would gain through this partnership with Achilles,” said Grigoris Lamprou, Co-Founder and CEO of Procureship. “For our clients, the ability to easily access information on supplier sustainability practices reinforces trust across the supply chain.” Shipping sector purchasing process “The aim of Achilles is to ensure that procurement professionals within the shipping sector have a streamlined purchasing process that improves visibility, drives ESG metrics and increases process efficiency,” said Paul Stanley, CEO, Achilles. “Including supplier sustainability data within an e-commerce platform like Procureship, cements this strategy with a simplified, yet robust process.”

The keel laying ceremony for "Seven Seas Prestige", the ultra-luxury cruise ship which Fincantieri is building for Regent Seven Seas Cruises, took place at Fincantieri's shipyard in Marghera (Venice). The vessel is scheduled for delivery in 2026. Cruise industry milestone The ceremony was attended, among others, by Harry Sommer, President & Chief Executive Officer of Norwegian Cruise Line Holdings Ltd, Jason Montague, Chief Luxury Officer of Regent Seven Seas Cruises, Patrik Dahlgren, Executive Vice President, Chief Vessel Operations and Newbuild Officer Norwegian Cruise Line Holdings Ltd., Daniele Fanara, Fincantieri Senior Vice President New Building and After Sales, and Marco Lunardi, Senior Vice President Marghera shipyard. Crafted for luxury Three specially chosen coins were welded onto the bottom of the ship as part of a longstanding maritime traditionDuring the event, three specially chosen coins were welded onto the bottom of the ship as part of a longstanding maritime tradition and a symbol of good luck and blessing for the vessel. With a gross tonnage of 77,000 tons and a length of 257 meters, "Seven Seas Prestige" will accommodate approximately 850 passengers in 434 spacious suites, offering one of the highest guest-to-space ratios in the industry. The ship will embody sophist cation and refinement that is the epitome of timeless elegance, integrating the most advanced environmental technologies and introducing new accommodation categories, new dining and many more incredible experiences for luxury travelers. Luxury redefined "Seven Seas Prestige" will be the first vessel in the new Prestige Class, a generation of ships following the highly successful Explorer series, also built by Fincantieri: "Seven Seas Explorer" (2016), "Seven Seas Splendor" (2020), and "Seven Seas Grandeur" (2023), delivered respectively from the Sestri Ponente (Genoa) and Ancona shipyards.

Knutsen NYK Carbon Carriers AS, a subsidiary of Nippon Yusen Kabushiki Kaisha and Knutsen Group, has obtained Approval in Principle from ClassNK for the design of liquified CO2 carriers that use the elevated pressure method to store and transport liquefied carbon dioxide at ambient temperature. ClassNK has carried out a design review of this ship in accordance with the Rules for the Survey and Construction of Steel Ships, 'Part N', and has issued an Approval in Principle after confirming that the ship meets the prescribed requirements. Advancing carbon storage The LCO2-EP carrier uses LCO2-EP Cargo Tank technology developed by KNCC to transport LCO2The LCO2-EP carrier uses LCO2-EP Cargo Tank technology developed by KNCC to transport LCO2 in a stable state. Since there is no need to cool LCO2 to cryogenic temperatures, it is easy to handle and potentially reduces energy and costs during liquefaction. NYK, KNCC, and ENEOS Xplora Inc. have developed a Floating Liquefied Storage Unit that combines the LCO2-EP Cargo Tank technology with the Isenthalpic Expansion Cooling & Liquefaction Process. This Process has been researched and developed in collaboration among the three companies. ClassNK has issued an AiP following a review based on the Rules for the Survey and Construction of Steel Ships, 'Part PS', 'Guidelines for the Design of Floating Liquefied Natural Gas and Liquefied Petroleum Gas Production, Storage, Offloading and Regasification Units', etc. Innovative carbon solution This FLSU is a pioneering concept that liquefies and temporarily stores CO2 that has been collected and transported as gas in an onshore facility making it ready for further transport by LCO2 carrier. By utilising the features of the EP method, which has the potential to reduce the energy required for liquefaction, and adopting the Process, which is expected to be simpler and more compact than conventional cooling methods, it has become possible to install a liquefaction plant on a floating structure. Scaling carbon solutions Carbon Capture, Utilisation and Storage is one area that is expected to play a certain role in achieving a carbon-neutral society. However, issues need to be addressed, such as reducing overall costs and securing land for liquefaction and storage facilities. By utilising this FLSU, the cost of CO2 liquefaction and the land area required onshore in the CCUS value chain can be reduced, expanding the possibilities for realising CCUS. Towards a greener future NYK, KNCC, ENEOS Xplora, and ClassNK will continue to contribute to realising a carbon-neutral society by examining various technologies and assessing their economic and safety aspects towards achieving a CCUS value chain.

The University of Osaka (President: Atsushi Kumanogoh), in collaboration with Imabari Shipbuilding Co., Ltd. (President: Yukito Higaki, 'Imabari Shipbuilding'), Japan Marine United Corporation (President: Takashi Hirose, 'JMU'), Nippon Kaiji Kyokai (President & CEO: Hayato Suga, 'ClassNK'), and MTI Co., Ltd. (President: Hideki Suzuki, 'MTI') will establish the Open Collaboration Laboratory for Enabling Advanced Marine Systems (OCEANS) at the Techno Alliance Building within the Graduate School of Engineering at The University of Osaka in April 2025. Japan’s maritime industry In addition, Nihon Shipyard Co., Ltd. (President: Kiyoshi Higaki, hereinafter referred to as 'NSY'), a sales and design company owned by Imabari Shipbuilding and Japan Marine United Corporation (JMU), will also cooperate with this program. NSY will actively participate in the design and engineering research activities led by OCEANS. This initiative aims to promote the global competitiveness of Japan’s maritime industry. The attention to the OCEANS initiative is greatly appreciated. Background and objectives of collaboration Japanese maritime industry is being called upon to make revolutionary change In an era of unprecedented change, driven by rising geopolitical risks, growing awareness of economic security, climate change, the rapid development of technologies such as AI and their social impact, and the ageing population in developed countries, the Japanese maritime industry is being called upon to make revolutionary transformation. A major revolution in design and manufacturing processes is needed to quickly supply high-performance next-generation ships that embody innovative functions, excellent environmental performance and safety features, to customers. Advanced systems engineering and cutting-edge AI technologies This collaboration, established under the 'Industry on Campus' program promoted by The University of Osaka, integrates diverse engineering fields such as ship hydro and structural dynamics, propulsion, electrical systems, and control systems. Leveraging advanced systems engineering and cutting-edge AI technologies, this initiative also serves as a hub for education and training of the next generation of talent. For Japan, which is surrounded by sea, the maritime industry, that supplies and operates ships for marine transportation is fundamental for social and economic stability and people’s living. Japan’s shipbuilding industry is highly regarded worldwide for its design and construction technologies. International maritime safety standards and criteria The shipping industry has one of the world’s largest fleets and excellent safe and efficient carrier technologies The shipping industry has one of the world’s largest fleets and excellent safe and efficient transportation technologies. The classification society develops classification rules and conducts certification services for safe and efficient marine transportation, and the number of ships certified by it is one of the highest in the world. The Graduate School of Engineering at The University of Osaka, particularly its Department of Naval Architecture and Ocean Engineering, has achieved global recognition for its research on ships and marine structures. The department has contributed significantly to international maritime safety standards and criteria, collaborating with leading companies and fostering interdisciplinary, advanced research. Net-zero greenhouse gas (GHG) emissions International shipping has set a goal to achieve net-zero greenhouse gas (GHG) emissions by around 2050, with Japan’s maritime industry expected to play a crucial role in achieving this target. In addition to the essential transition to alternative fuels for GHG reduction, advancements in ship automation technologies are anticipated to progress further. This will undoubtedly lead to increased complexity in the processes of design, construction, certification, and operation. To address these challenges, innovative systems engineering leveraging cutting-edge technologies such as AI will be indispensable for the future of the maritime industry. This research laboratory will undertake these studies, contributing to the enhancement of the global competitiveness of Japan’s maritime industry. Collaborative research program The top goal is to prove itself as a research and academic hub that drives the maritime industry forward This collaborative research program leverages the strengths of Japan's world-renowned maritime industry cluster, including shipbuilding, shipping, and ship classification. By deepening industry-academia collaboration, it aims to enhance international competitiveness, advance world-class research, and foster talent development. The ultimate goal is to establish itself as a pioneering research and educational hub that drives the global maritime industry forward. Overview of the laboratory Name: Open Collaboration Laboratory for Enabling Advanced Marine Systems (OCEANS) Duration: April 1, 2025 – March 31, 2030 (5 years) Location: Techno Alliance Building A 804-806, The University of Osaka Faculty and Research Team (As of April 1, 2025) Full-Time Faculty: Specially Appointed Assoc. Prof. Yasuo Ichinose, Specially Appointed Asst. Prof. Kouki Wakita Part-Time Faculty: Prof. Atsuo Maki, Prof. Kazuhiro Iijima, Prof. Munehiko Minoura, Prof. Naoki Osawa, Assoc. Prof. Akira Tatsumi, Assoc. Prof. Masahiro Sakai, Asst. Prof. Takayuki Takeuchi Visiting Faculty: Visiting Prof. (currently being selected), Visiting Assoc. Prof. (currently being selected) Researchers from participating companies: Approximately 10 researchers Research focus areas Basic research on innovative systems engineering and design automation Resilience of the supply chain for stable marine transportation Application of AI in ship basic design, function design, and certification Production design and digital shipyards Digital twin technologies in ship operation and maintenance Individual studies on design, construction, operation, and certification, including both open and closed research projects Education and training for the next generation of maritime industry experts

Eni, an energy company, Fincantieri, a world pioneer in complex shipbuilding, and RINA, a multinational group specialising in engineering consultancy, certification, and inspection, presented the “Sustainable Maritime Transport Outlook” in Rome — in the presence of the Minister for the Environment and Energy Security, Gilberto Pichetto Fratin. The study, focused on the maritime sector, was developed with the technical support of Bain & Company Italy. Net Zero target for 2050 The study aims to contribute to accelerating the decarbonisation of the maritime transport sector The study aims to contribute to accelerating the decarbonisation of the maritime transport sector, in line with the Net Zero target for 2050. It forms part of the broader framework of the agreement signed on March 25, 2024, by Eni, Fincantieri, and RINA, with the shared goal of establishing a global observatory to monitor and assess the medium- to long-term evolution of sustainable decarbonisation solutions for the sector. Carbon neutrality by 2050 The maritime industry is responsible for approximately 3% of global CO2 emissions and is committed to achieving carbon neutrality by 2050. To reach this goal, a clear and realistic roadmap is essential — one that minimises uncertainty and risk for investors while offering practical, economically viable solutions for the entire industry. Cost implications for shipowners Overview of viable decarbonisation options tailored to different vessel segments and regions Addressing this need through a holistic approach, the study provides, for the first time, a global overview of viable decarbonisation options tailored to different vessel segments and regions worldwide. It also integrates volume assessments with a comprehensive analysis of cost implications for shipowners and the investment requirements across the logistics and port infrastructure chain. In the short term, the energy carriers most capable of reducing CO2 emissions include: LNG (liquefied natural gas) – a fossil fuel with lower carbon intensity, though it requires significant infrastructure investments for storage, handling, and bunkering at ports. Biofuels – including HVO, which can be used in its pure form without the need for infrastructure upgrades, and FAME which faces significant limitations when used in pure form. Merchant shipping sector Over the long term, biofuels — including the emergence of Bio-LNG and biomethanol — are expected to remain the primary solution for the merchant shipping sector. Synthetic fuels derived from green hydrogen, along with hydrogen itself, are also likely to gain traction in specific applications — such as low- and medium-power cruise ships — as their competitiveness improves and supply chains continue to develop. Development and implementation of impactful initiatives Synthetic fuels derived from green hydrogen, along with hydrogen itself, are also likely to gain traction Giuseppe Ricci, Chief Operating Officer for Industrial Transformation at Eni, commented: “A year ago, together with Fincantieri and RINA, we committed to developing a global observatory focused on the evolving landscape of sustainable decarbonisation solutions for the maritime sector." "This study — the result of combined expertise, resources, and technologies from key industry players — has produced a clear and actionable framework that can guide the development and implementation of impactful initiatives to decarbonise maritime transport across various segments, while considering the full supply chain." "As also recognised at the EU level, there is growing consensus that biofuels — particularly those already available and usable in their pure form, like HVO — are among the most effective solutions currently available to reduce GHG emissions in the maritime sector.” Sustainable Maritime Transport Outlook Pierroberto Folgiero, Chief Executive Officer and General Manager of Fincantieri, stated: “Decarbonising maritime transport is a challenge that demands industrial vision and the ability to turn innovation into real-world solutions. The Sustainable Maritime Transport Outlook presented today marks a strategic step in that direction — an integrated analysis grounded in real data and scenarios, developed with the support of pioneering players across the sector." "This is also the foundation for our commitment to establish a global observatory, reinforcing our role in driving the transition toward lower environmental impact, while creating value and ensuring competitiveness throughout the entire ship lifecycle. With our Net Zero Ship goal set for 2035, Fincantieri is looking ahead — pioneering the change and integrating technology and sustainability to stay competitive in the long term.” Shipping and transport value chain Carlo Luzzatto, Chief Executive Officer and General Manager of RINA stated: “Knowledge transfer is a key enabler in accelerating the energy transition. Our ability to bring together expertise and experience from different sectors — particularly energy and maritime, where we have a long-standing presence — allows us to develop effective decarbonisation solutions." "Partnerships like this one with Eni and Fincantieri are essential for turning innovation into practical applications, creating value for all players across the shipping and transport value chain.” Future low-emission maritime routes Pierluigi Serlenga, Managing Partner Italy at Bain & Company, added: “Industry stakeholders and investors need a clear vision to guide technological choices and investment strategies. With this first edition of the Observatory, we’ve delivered a valuable tool to help interpret the evolution of the fuel mix in both the short and long term." "Starting around 2040, new solutions will gradually be adopted on specific routes and use cases, complementing biofuels and LNG — although the latter will need to come from bio-based sources. It’s therefore critical to develop a roadmap for upgrading Italy’s port infrastructure to ensure it remains competitive and central to future low-emission maritime routes." "We estimate that by 2050, around €24 billion in investments will be needed across the European port system — a significant share of which represents a real business opportunity for the Italian maritime value chain.” Adoption of new technologies and alternative fuels Maritime sector remains heavily reliant on traditional fuels, which account for 93% of total energy consumption Now, the maritime sector remains heavily reliant on traditional fuels, which account for 93% of total energy consumption. The goal of achieving net-zero emissions by 2050 is driving a major transformation across the industry, with increasing adoption of alternative propulsion sources. In 2023, around 50% of new ship orders were designed for alternative fuels, reflecting a shift toward greater sustainability. Ports are beginning to adapt, developing infrastructure to support a range of new fuel and technology options — but progress remains insufficient. The adoption of new technologies and alternative fuels will depend on a complex mix of factors, including national and regional energy strategies, consumer behaviour, macroeconomic trends, geopolitical developments, supply chain risks, and the pace of technological advancement. Levels of decarbonisation ambition The Outlook presents three future scenarios, each based on varying levels of decarbonisation ambition, technological progress, and availability of fuels and infrastructure. HVO is already available at key ports and offers a degree of cost resilience Projections suggest that decarbonisation will advance more rapidly in the EU and the United States, while fossil fuels and LNG will continue to dominate in the Asia-Pacific region and other parts of the world — making up approximately 70% of the energy mix by 2050. Between 2030 and 2040, Europe and North America are expected to see a major shift from fossil fuels to HVO biofuels — which will serve as the cornerstone of the transition — and to LNG, including its bio-derived form. HVO is already available at key ports and offers a degree of cost resilience, while LNG remains economically competitive in the near term, though it will face increasing regulatory penalties from 2040 onward. Carbon neutrality by 2050 To achieve carbon neutrality by 2050, the industry will also need to explore new alternative fuels, such as synthetic fuels produced from green hydrogen. However, these are not expected to become cost-competitive with fossil fuels until after 2040. Industry need to explore new alternative fuels, such as synthetic fuels produced from green hydrogen In the long term, biofuels derived from renewable feedstocks and synthetic fuels will be essential for decarbonising medium- and long-range merchant vessels. For short-range ships, bioenergy solutions will be sufficient. In the cruise segment, small to mid-sized vessels (luxury and exploration classes) are expected to adopt both HVO biofuels and synthetic fuels, while larger vessels (upper premium and contemporary classes) will rely more heavily on bioenergy sources such as HVO, bio-LNG, and biomethanol. Distribution of alternative fuels Successfully managing this transition will require significant long-term investment in port infrastructure to accommodate the supply and distribution of alternative fuels. Within the European Union alone, investments of up to €24 billion are projected. In terms of infrastructure needs, HVO biofuels and LNG will require relatively limited investment (around 15%), due to their compatibility with existing systems. In contrast, synthetic fuels will demand substantial investment (around 85%), as the necessary infrastructure has yet to be developed.

Zero USV, the company behind the Oceanus12 fleet, providing the first global network of over-the-horizon, high-endurance uncrewed fully autonomous surface vessels (USVs) for charter, has officially welcomed Leeway Marine onboard as its first global operations partner. This partnership represents a landmark step in expanding Zero USV’s worldwide presence, with Leeway Marine now set to offer the company’s Oceanus12 USV for charter throughout Canada and the wider North American region. Pioneering vessel solutions This collaboration between the two companies arrives at a time when global interest in uncrewed This collaboration between the two companies arrives at a time when global interest in uncrewed. The charter-based business model is pioneering for this region and beyond; organisations no longer need to invest in costly ownership to harness the benefits of utilising a USV already set up with edge-based autonomy fed by sophisticated algorithms using data fusion from an advanced sensor suite. This collaboration between the two companies arrives at a time when global interest in uncrewed, high-endurance vessel solutions is surging, not least within the defence sector, where continuous maritime surveillance, border security, and rapid-response capabilities in contested waters have become increasingly critical. Maritime operations excellence Based in Halifax, Nova Scotia, Leeway Group was founded in 2015 by former navy professionals and is now one of Canada’s largest charter vessel suppliers in the offshore survey and defence charter market. The Group of companies includes Leeway Marine, Leeway Vessel Management, Offshore Crewing and related US subsidiaries. With operations in Canada, US and the Indo-Pacific Region, Leeway is poised to create significant growth for the Zero USV brand in current and emerging markets. Technology integration It is this core experience and knowledge which gives ZeroUSV the confidence that Leeway Marine is the right partner to take the Oceanus12 on and work it up to meet local requirements, leveraging its deep knowledge of Canadian waters and maritime operations. This collaboration ensures that Zero USV’s cutting-edge technology, specifically developed for over-the-horizon missions, is paired with specialised, in-territory expertise. Autonomous marine solutions The Oceanus12 is a next-generation uncrewed surface vessel, designed from the keel up for extended, high endurance, fully autonomous missions. Key features include a twin hybrid-electric propulsion system for ultimate reliability and fuel efficiency, an advanced autonomy software stack powered by MarineAI’s GuardianAI software, and a mission-agnostic platform that can be configured for a diverse range of operations. Seamless integration commitment Zero USV’s commitment to ‘turnkey’ solutions also providing its own Remote Observation Centre Zero USV’s commitment to ‘turnkey’ solutions is backed by it also providing its own Remote Observation Centre (ROC), ensuring seamless integration and allowing customers to simply “charter and go”. ZeroUSV founder, Matthew Ratsey, said: “We are absolutely delighted to be bringing a company of the caliber and track record of Leeway Marine into the ZeroUSV network. To have Leeway Marine as our first global franchisee is a huge milestone for both companies and Leeway’s strong track record in the Canadian maritime sector makes it the ideal partner to champion Oceanus12 in North America." “Our vision has always been to operationally scale ZeroUSV as fast as practically possible and to do this by creating a robust global network of key partners operating Oceanus12 uncrewed vessels that can address the wide range of operational needs, Leeway Marine as an early adopter will play a key role in helping us achieve the global reach we are striving for.” Global franchise milestone Jamie Sangster (CEO Leeway Group), said: “Becoming Zero USV’s first global franchisee underscores our commitment to delivering the most advanced uncrewed capabilities. We see enormous potential for Oceanus12 - from defence and security tasks to environmental surveys and infrastructure monitoring. By coupling our regional expertise with Zero USV’s proven platform, we aim to bring the benefits of autonomous maritime operations to more organisations across the North American continent.”

Achilles, a pioneer in supply chain risk management solutions, and Procureship, the world’s pioneering e-procurement platform, have agreed on a long-term partnership to enhance the ESG capabilities of the shipping industry’s procurement processes. The latest agreement will bring efficiencies to the supply chain assessment and purchasing process for Procureship members. Procureship provides streamlined purchasing for more than 100 fleet owners and operators, including BW LNG, Angelicoussis Group, Oldendorff Carriers, Starbulk Group, TB Marine and Technomar. Benefit from standardised processes Achilles Maritime Network provides a forum for shipowners and chiefs to team By leveraging advanced analytics, machine learning tools, and a unique supplier recommendation engine, Procureship simplifies the procurement process between buyers and suppliers. The Achilles Maritime Network provides a platform for shipowners and managers to collaborate, reduce risks, and enhance supply chain visibility while lowering costs and administrative burdens. Suppliers and contractors benefit from standardised processes and pre-qualification, fostering stronger relationships and business growth. Users of the Procureship platform The network supports transparency, sustainability, and responsible business practices in the maritime industry. Members of the Achilles Maritime Network include BW LNG and LPG, Odfjell, Seapeak and Seasourcing. Through this agreement, users of the Procureship platform can access the Achilles service to improve visibility of their suppliers’ sustainability performance. Procureship will also offer its supplier network the opportunity to demonstrate their Achilles score and standout through a rigorous, independent assessment. Procureship’s supplier profiles Buyers are able to check the suppliers’ Achilles scores on the spot during the evaluation of quotes The Achilles Sustainability Score will be reflected in Procureship’s supplier profiles and displayed in supplier search engine results. Additionally, buyers will be able to check the suppliers’ Achilles scores on the spot during the evaluation of quotations. This will allow maritime purchasers to easily source products from companies that align with their standards, providing greater transparency and confidence in their procurement decisions. ESG module to marketplace services “Procureship identified the need for an ESG module to complement our existing marketplace services and recognised the expertise we would gain through this partnership with Achilles,” said Grigoris Lamprou, Co-Founder and CEO of Procureship. “For our clients, the ability to easily access information on supplier sustainability practices reinforces trust across the supply chain.” Shipping sector purchasing process “The aim of Achilles is to ensure that procurement professionals within the shipping sector have a streamlined purchasing process that improves visibility, drives ESG metrics and increases process efficiency,” said Paul Stanley, CEO, Achilles. “Including supplier sustainability data within an e-commerce platform like Procureship, cements this strategy with a simplified, yet robust process.”

The keel laying ceremony for "Seven Seas Prestige", the ultra-luxury cruise ship which Fincantieri is building for Regent Seven Seas Cruises, took place at Fincantieri's shipyard in Marghera (Venice). The vessel is scheduled for delivery in 2026. Cruise industry milestone The ceremony was attended, among others, by Harry Sommer, President & Chief Executive Officer of Norwegian Cruise Line Holdings Ltd, Jason Montague, Chief Luxury Officer of Regent Seven Seas Cruises, Patrik Dahlgren, Executive Vice President, Chief Vessel Operations and Newbuild Officer Norwegian Cruise Line Holdings Ltd., Daniele Fanara, Fincantieri Senior Vice President New Building and After Sales, and Marco Lunardi, Senior Vice President Marghera shipyard. Crafted for luxury Three specially chosen coins were welded onto the bottom of the ship as part of a longstanding maritime traditionDuring the event, three specially chosen coins were welded onto the bottom of the ship as part of a longstanding maritime tradition and a symbol of good luck and blessing for the vessel. With a gross tonnage of 77,000 tons and a length of 257 meters, "Seven Seas Prestige" will accommodate approximately 850 passengers in 434 spacious suites, offering one of the highest guest-to-space ratios in the industry. The ship will embody sophist cation and refinement that is the epitome of timeless elegance, integrating the most advanced environmental technologies and introducing new accommodation categories, new dining and many more incredible experiences for luxury travelers. Luxury redefined "Seven Seas Prestige" will be the first vessel in the new Prestige Class, a generation of ships following the highly successful Explorer series, also built by Fincantieri: "Seven Seas Explorer" (2016), "Seven Seas Splendor" (2020), and "Seven Seas Grandeur" (2023), delivered respectively from the Sestri Ponente (Genoa) and Ancona shipyards.

Knutsen NYK Carbon Carriers AS, a subsidiary of Nippon Yusen Kabushiki Kaisha and Knutsen Group, has obtained Approval in Principle from ClassNK for the design of liquified CO2 carriers that use the elevated pressure method to store and transport liquefied carbon dioxide at ambient temperature. ClassNK has carried out a design review of this ship in accordance with the Rules for the Survey and Construction of Steel Ships, 'Part N', and has issued an Approval in Principle after confirming that the ship meets the prescribed requirements. Advancing carbon storage The LCO2-EP carrier uses LCO2-EP Cargo Tank technology developed by KNCC to transport LCO2The LCO2-EP carrier uses LCO2-EP Cargo Tank technology developed by KNCC to transport LCO2 in a stable state. Since there is no need to cool LCO2 to cryogenic temperatures, it is easy to handle and potentially reduces energy and costs during liquefaction. NYK, KNCC, and ENEOS Xplora Inc. have developed a Floating Liquefied Storage Unit that combines the LCO2-EP Cargo Tank technology with the Isenthalpic Expansion Cooling & Liquefaction Process. This Process has been researched and developed in collaboration among the three companies. ClassNK has issued an AiP following a review based on the Rules for the Survey and Construction of Steel Ships, 'Part PS', 'Guidelines for the Design of Floating Liquefied Natural Gas and Liquefied Petroleum Gas Production, Storage, Offloading and Regasification Units', etc. Innovative carbon solution This FLSU is a pioneering concept that liquefies and temporarily stores CO2 that has been collected and transported as gas in an onshore facility making it ready for further transport by LCO2 carrier. By utilising the features of the EP method, which has the potential to reduce the energy required for liquefaction, and adopting the Process, which is expected to be simpler and more compact than conventional cooling methods, it has become possible to install a liquefaction plant on a floating structure. Scaling carbon solutions Carbon Capture, Utilisation and Storage is one area that is expected to play a certain role in achieving a carbon-neutral society. However, issues need to be addressed, such as reducing overall costs and securing land for liquefaction and storage facilities. By utilising this FLSU, the cost of CO2 liquefaction and the land area required onshore in the CCUS value chain can be reduced, expanding the possibilities for realising CCUS. Towards a greener future NYK, KNCC, ENEOS Xplora, and ClassNK will continue to contribute to realising a carbon-neutral society by examining various technologies and assessing their economic and safety aspects towards achieving a CCUS value chain.

The University of Osaka (President: Atsushi Kumanogoh), in collaboration with Imabari Shipbuilding Co., Ltd. (President: Yukito Higaki, 'Imabari Shipbuilding'), Japan Marine United Corporation (President: Takashi Hirose, 'JMU'), Nippon Kaiji Kyokai (President & CEO: Hayato Suga, 'ClassNK'), and MTI Co., Ltd. (President: Hideki Suzuki, 'MTI') will establish the Open Collaboration Laboratory for Enabling Advanced Marine Systems (OCEANS) at the Techno Alliance Building within the Graduate School of Engineering at The University of Osaka in April 2025. Japan’s maritime industry In addition, Nihon Shipyard Co., Ltd. (President: Kiyoshi Higaki, hereinafter referred to as 'NSY'), a sales and design company owned by Imabari Shipbuilding and Japan Marine United Corporation (JMU), will also cooperate with this program. NSY will actively participate in the design and engineering research activities led by OCEANS. This initiative aims to promote the global competitiveness of Japan’s maritime industry. The attention to the OCEANS initiative is greatly appreciated. Background and objectives of collaboration Japanese maritime industry is being called upon to make revolutionary change In an era of unprecedented change, driven by rising geopolitical risks, growing awareness of economic security, climate change, the rapid development of technologies such as AI and their social impact, and the ageing population in developed countries, the Japanese maritime industry is being called upon to make revolutionary transformation. A major revolution in design and manufacturing processes is needed to quickly supply high-performance next-generation ships that embody innovative functions, excellent environmental performance and safety features, to customers. Advanced systems engineering and cutting-edge AI technologies This collaboration, established under the 'Industry on Campus' program promoted by The University of Osaka, integrates diverse engineering fields such as ship hydro and structural dynamics, propulsion, electrical systems, and control systems. Leveraging advanced systems engineering and cutting-edge AI technologies, this initiative also serves as a hub for education and training of the next generation of talent. For Japan, which is surrounded by sea, the maritime industry, that supplies and operates ships for marine transportation is fundamental for social and economic stability and people’s living. Japan’s shipbuilding industry is highly regarded worldwide for its design and construction technologies. International maritime safety standards and criteria The shipping industry has one of the world’s largest fleets and excellent safe and efficient carrier technologies The shipping industry has one of the world’s largest fleets and excellent safe and efficient transportation technologies. The classification society develops classification rules and conducts certification services for safe and efficient marine transportation, and the number of ships certified by it is one of the highest in the world. The Graduate School of Engineering at The University of Osaka, particularly its Department of Naval Architecture and Ocean Engineering, has achieved global recognition for its research on ships and marine structures. The department has contributed significantly to international maritime safety standards and criteria, collaborating with leading companies and fostering interdisciplinary, advanced research. Net-zero greenhouse gas (GHG) emissions International shipping has set a goal to achieve net-zero greenhouse gas (GHG) emissions by around 2050, with Japan’s maritime industry expected to play a crucial role in achieving this target. In addition to the essential transition to alternative fuels for GHG reduction, advancements in ship automation technologies are anticipated to progress further. This will undoubtedly lead to increased complexity in the processes of design, construction, certification, and operation. To address these challenges, innovative systems engineering leveraging cutting-edge technologies such as AI will be indispensable for the future of the maritime industry. This research laboratory will undertake these studies, contributing to the enhancement of the global competitiveness of Japan’s maritime industry. Collaborative research program The top goal is to prove itself as a research and academic hub that drives the maritime industry forward This collaborative research program leverages the strengths of Japan's world-renowned maritime industry cluster, including shipbuilding, shipping, and ship classification. By deepening industry-academia collaboration, it aims to enhance international competitiveness, advance world-class research, and foster talent development. The ultimate goal is to establish itself as a pioneering research and educational hub that drives the global maritime industry forward. Overview of the laboratory Name: Open Collaboration Laboratory for Enabling Advanced Marine Systems (OCEANS) Duration: April 1, 2025 – March 31, 2030 (5 years) Location: Techno Alliance Building A 804-806, The University of Osaka Faculty and Research Team (As of April 1, 2025) Full-Time Faculty: Specially Appointed Assoc. Prof. Yasuo Ichinose, Specially Appointed Asst. Prof. Kouki Wakita Part-Time Faculty: Prof. Atsuo Maki, Prof. Kazuhiro Iijima, Prof. Munehiko Minoura, Prof. Naoki Osawa, Assoc. Prof. Akira Tatsumi, Assoc. Prof. Masahiro Sakai, Asst. Prof. Takayuki Takeuchi Visiting Faculty: Visiting Prof. (currently being selected), Visiting Assoc. Prof. (currently being selected) Researchers from participating companies: Approximately 10 researchers Research focus areas Basic research on innovative systems engineering and design automation Resilience of the supply chain for stable marine transportation Application of AI in ship basic design, function design, and certification Production design and digital shipyards Digital twin technologies in ship operation and maintenance Individual studies on design, construction, operation, and certification, including both open and closed research projects Education and training for the next generation of maritime industry experts

Eni, an energy company, Fincantieri, a world pioneer in complex shipbuilding, and RINA, a multinational group specialising in engineering consultancy, certification, and inspection, presented the “Sustainable Maritime Transport Outlook” in Rome — in the presence of the Minister for the Environment and Energy Security, Gilberto Pichetto Fratin. The study, focused on the maritime sector, was developed with the technical support of Bain & Company Italy. Net Zero target for 2050 The study aims to contribute to accelerating the decarbonisation of the maritime transport sector The study aims to contribute to accelerating the decarbonisation of the maritime transport sector, in line with the Net Zero target for 2050. It forms part of the broader framework of the agreement signed on March 25, 2024, by Eni, Fincantieri, and RINA, with the shared goal of establishing a global observatory to monitor and assess the medium- to long-term evolution of sustainable decarbonisation solutions for the sector. Carbon neutrality by 2050 The maritime industry is responsible for approximately 3% of global CO2 emissions and is committed to achieving carbon neutrality by 2050. To reach this goal, a clear and realistic roadmap is essential — one that minimises uncertainty and risk for investors while offering practical, economically viable solutions for the entire industry. Cost implications for shipowners Overview of viable decarbonisation options tailored to different vessel segments and regions Addressing this need through a holistic approach, the study provides, for the first time, a global overview of viable decarbonisation options tailored to different vessel segments and regions worldwide. It also integrates volume assessments with a comprehensive analysis of cost implications for shipowners and the investment requirements across the logistics and port infrastructure chain. In the short term, the energy carriers most capable of reducing CO2 emissions include: LNG (liquefied natural gas) – a fossil fuel with lower carbon intensity, though it requires significant infrastructure investments for storage, handling, and bunkering at ports. Biofuels – including HVO, which can be used in its pure form without the need for infrastructure upgrades, and FAME which faces significant limitations when used in pure form. Merchant shipping sector Over the long term, biofuels — including the emergence of Bio-LNG and biomethanol — are expected to remain the primary solution for the merchant shipping sector. Synthetic fuels derived from green hydrogen, along with hydrogen itself, are also likely to gain traction in specific applications — such as low- and medium-power cruise ships — as their competitiveness improves and supply chains continue to develop. Development and implementation of impactful initiatives Synthetic fuels derived from green hydrogen, along with hydrogen itself, are also likely to gain traction Giuseppe Ricci, Chief Operating Officer for Industrial Transformation at Eni, commented: “A year ago, together with Fincantieri and RINA, we committed to developing a global observatory focused on the evolving landscape of sustainable decarbonisation solutions for the maritime sector." "This study — the result of combined expertise, resources, and technologies from key industry players — has produced a clear and actionable framework that can guide the development and implementation of impactful initiatives to decarbonise maritime transport across various segments, while considering the full supply chain." "As also recognised at the EU level, there is growing consensus that biofuels — particularly those already available and usable in their pure form, like HVO — are among the most effective solutions currently available to reduce GHG emissions in the maritime sector.” Sustainable Maritime Transport Outlook Pierroberto Folgiero, Chief Executive Officer and General Manager of Fincantieri, stated: “Decarbonising maritime transport is a challenge that demands industrial vision and the ability to turn innovation into real-world solutions. The Sustainable Maritime Transport Outlook presented today marks a strategic step in that direction — an integrated analysis grounded in real data and scenarios, developed with the support of pioneering players across the sector." "This is also the foundation for our commitment to establish a global observatory, reinforcing our role in driving the transition toward lower environmental impact, while creating value and ensuring competitiveness throughout the entire ship lifecycle. With our Net Zero Ship goal set for 2035, Fincantieri is looking ahead — pioneering the change and integrating technology and sustainability to stay competitive in the long term.” Shipping and transport value chain Carlo Luzzatto, Chief Executive Officer and General Manager of RINA stated: “Knowledge transfer is a key enabler in accelerating the energy transition. Our ability to bring together expertise and experience from different sectors — particularly energy and maritime, where we have a long-standing presence — allows us to develop effective decarbonisation solutions." "Partnerships like this one with Eni and Fincantieri are essential for turning innovation into practical applications, creating value for all players across the shipping and transport value chain.” Future low-emission maritime routes Pierluigi Serlenga, Managing Partner Italy at Bain & Company, added: “Industry stakeholders and investors need a clear vision to guide technological choices and investment strategies. With this first edition of the Observatory, we’ve delivered a valuable tool to help interpret the evolution of the fuel mix in both the short and long term." "Starting around 2040, new solutions will gradually be adopted on specific routes and use cases, complementing biofuels and LNG — although the latter will need to come from bio-based sources. It’s therefore critical to develop a roadmap for upgrading Italy’s port infrastructure to ensure it remains competitive and central to future low-emission maritime routes." "We estimate that by 2050, around €24 billion in investments will be needed across the European port system — a significant share of which represents a real business opportunity for the Italian maritime value chain.” Adoption of new technologies and alternative fuels Maritime sector remains heavily reliant on traditional fuels, which account for 93% of total energy consumption Now, the maritime sector remains heavily reliant on traditional fuels, which account for 93% of total energy consumption. The goal of achieving net-zero emissions by 2050 is driving a major transformation across the industry, with increasing adoption of alternative propulsion sources. In 2023, around 50% of new ship orders were designed for alternative fuels, reflecting a shift toward greater sustainability. Ports are beginning to adapt, developing infrastructure to support a range of new fuel and technology options — but progress remains insufficient. The adoption of new technologies and alternative fuels will depend on a complex mix of factors, including national and regional energy strategies, consumer behaviour, macroeconomic trends, geopolitical developments, supply chain risks, and the pace of technological advancement. Levels of decarbonisation ambition The Outlook presents three future scenarios, each based on varying levels of decarbonisation ambition, technological progress, and availability of fuels and infrastructure. HVO is already available at key ports and offers a degree of cost resilience Projections suggest that decarbonisation will advance more rapidly in the EU and the United States, while fossil fuels and LNG will continue to dominate in the Asia-Pacific region and other parts of the world — making up approximately 70% of the energy mix by 2050. Between 2030 and 2040, Europe and North America are expected to see a major shift from fossil fuels to HVO biofuels — which will serve as the cornerstone of the transition — and to LNG, including its bio-derived form. HVO is already available at key ports and offers a degree of cost resilience, while LNG remains economically competitive in the near term, though it will face increasing regulatory penalties from 2040 onward. Carbon neutrality by 2050 To achieve carbon neutrality by 2050, the industry will also need to explore new alternative fuels, such as synthetic fuels produced from green hydrogen. However, these are not expected to become cost-competitive with fossil fuels until after 2040. Industry need to explore new alternative fuels, such as synthetic fuels produced from green hydrogen In the long term, biofuels derived from renewable feedstocks and synthetic fuels will be essential for decarbonising medium- and long-range merchant vessels. For short-range ships, bioenergy solutions will be sufficient. In the cruise segment, small to mid-sized vessels (luxury and exploration classes) are expected to adopt both HVO biofuels and synthetic fuels, while larger vessels (upper premium and contemporary classes) will rely more heavily on bioenergy sources such as HVO, bio-LNG, and biomethanol. Distribution of alternative fuels Successfully managing this transition will require significant long-term investment in port infrastructure to accommodate the supply and distribution of alternative fuels. Within the European Union alone, investments of up to €24 billion are projected. In terms of infrastructure needs, HVO biofuels and LNG will require relatively limited investment (around 15%), due to their compatibility with existing systems. In contrast, synthetic fuels will demand substantial investment (around 85%), as the necessary infrastructure has yet to be developed.

Zero USV, the company behind the Oceanus12 fleet, providing the first global network of over-the-horizon, high-endurance uncrewed fully autonomous surface vessels (USVs) for charter, has officially welcomed Leeway Marine onboard as its first global operations partner. This partnership represents a landmark step in expanding Zero USV’s worldwide presence, with Leeway Marine now set to offer the company’s Oceanus12 USV for charter throughout Canada and the wider North American region. Pioneering vessel solutions This collaboration between the two companies arrives at a time when global interest in uncrewed This collaboration between the two companies arrives at a time when global interest in uncrewed. The charter-based business model is pioneering for this region and beyond; organisations no longer need to invest in costly ownership to harness the benefits of utilising a USV already set up with edge-based autonomy fed by sophisticated algorithms using data fusion from an advanced sensor suite. This collaboration between the two companies arrives at a time when global interest in uncrewed, high-endurance vessel solutions is surging, not least within the defence sector, where continuous maritime surveillance, border security, and rapid-response capabilities in contested waters have become increasingly critical. Maritime operations excellence Based in Halifax, Nova Scotia, Leeway Group was founded in 2015 by former navy professionals and is now one of Canada’s largest charter vessel suppliers in the offshore survey and defence charter market. The Group of companies includes Leeway Marine, Leeway Vessel Management, Offshore Crewing and related US subsidiaries. With operations in Canada, US and the Indo-Pacific Region, Leeway is poised to create significant growth for the Zero USV brand in current and emerging markets. Technology integration It is this core experience and knowledge which gives ZeroUSV the confidence that Leeway Marine is the right partner to take the Oceanus12 on and work it up to meet local requirements, leveraging its deep knowledge of Canadian waters and maritime operations. This collaboration ensures that Zero USV’s cutting-edge technology, specifically developed for over-the-horizon missions, is paired with specialised, in-territory expertise. Autonomous marine solutions The Oceanus12 is a next-generation uncrewed surface vessel, designed from the keel up for extended, high endurance, fully autonomous missions. Key features include a twin hybrid-electric propulsion system for ultimate reliability and fuel efficiency, an advanced autonomy software stack powered by MarineAI’s GuardianAI software, and a mission-agnostic platform that can be configured for a diverse range of operations. Seamless integration commitment Zero USV’s commitment to ‘turnkey’ solutions also providing its own Remote Observation Centre Zero USV’s commitment to ‘turnkey’ solutions is backed by it also providing its own Remote Observation Centre (ROC), ensuring seamless integration and allowing customers to simply “charter and go”. ZeroUSV founder, Matthew Ratsey, said: “We are absolutely delighted to be bringing a company of the caliber and track record of Leeway Marine into the ZeroUSV network. To have Leeway Marine as our first global franchisee is a huge milestone for both companies and Leeway’s strong track record in the Canadian maritime sector makes it the ideal partner to champion Oceanus12 in North America." “Our vision has always been to operationally scale ZeroUSV as fast as practically possible and to do this by creating a robust global network of key partners operating Oceanus12 uncrewed vessels that can address the wide range of operational needs, Leeway Marine as an early adopter will play a key role in helping us achieve the global reach we are striving for.” Global franchise milestone Jamie Sangster (CEO Leeway Group), said: “Becoming Zero USV’s first global franchisee underscores our commitment to delivering the most advanced uncrewed capabilities. We see enormous potential for Oceanus12 - from defence and security tasks to environmental surveys and infrastructure monitoring. By coupling our regional expertise with Zero USV’s proven platform, we aim to bring the benefits of autonomous maritime operations to more organisations across the North American continent.”

Expert commentary

President Donald Trump has already made plenty of headlines since taking up his second term in the White House, including with the announcement of numerous new tariffs on imports. The 47th United States President issued three executive orders on February 1st 2025, just days after his inauguration, which directed the US to impose an additional 25 percent ad valorem rate of duty on imports from Canada and Mexico, as well as ten percent on imports from China. How Trump’s 2nd term as US President Cleveland Containers has analysed the early reactions to these announcements Excluding Canadian energy resources exports – which instead will be hit with a ten percent tariff – the tariffs have been applied to all imports which are either entered for consumption or withdrawn from warehouse for consumption on or after 12:01 am Eastern Standard Time on February 4th 2025. President Trump also told reporters on February 8th 2025 that a 25 percent tariff on all American steel and aluminium imports was coming into effect across the US during February. Leading 40ft shipping container supplier Cleveland Containers has analysed the early reactions to these announcements and how President Trump’s second term as US President could affect the world’s shipping industry, especially when looking back at his first term. Reaction to President Trump’s tariff announcements Mexico, Canada and China were all quick to react to President Trump’s announcement of tariffs on imports. Mexican President Claudia Sheinbaum said her country would vow for resilience against the measures, while a senior government official in Canada said that their country would challenge the decision by taking legal action through the necessary international bodies. China has also said it would be challenging the tariffs at the World Trade Organisation. According to the country’s finance ministry, as reported on by Geopolitical Intelligence Services, Beijing were moving to place levies of 15 percent on American coal and liquefied natural gas, as well as levies of ten percent on crude oil, certain vehicles and farm equipment. Beginning of making America rich again When it comes to the announcement of the tariff on all American steel and aluminium imports, President Trump told reporters in the Oval Office: "This is a big deal, the beginning of making America rich again. Our nation requires steel and aluminium to be made in America, not in foreign lands.” Francois-Phillippe Champagne, the Minister of Innovation in Canada, stated that the tariffs were "totally unjustified" though, before adding in a post on X: "Canadian steel and aluminium support key industries in the US, from defence, shipbuilding and auto. We will continue to stand up for Canada, our workers, and our industries." How might President Trump’s 2nd term affect shipping sector? Bruce Chan, an analyst in the Transportation and Future Mobility sectors at wealth management and investment banking Just ahead of President Trump taking office for the second time, J. Bruce Chan, an analyst in the Transportation and Future Mobility sectors at wealth management and investment banking firm Stifel, believed that the shipping industry was prepared for the new tariffs. However, he also stated to the Morning Star: "President Trump's Administration promises to usher in a new trade and tariff regime. As such, it's difficult to assess the ultimate impact to the freight transportation industry. Prima facie, we believe tariffs are a drag on freight demand, effectively resulting in higher costs for shippers that are generally passed on to end consumers over time." Attention to the American sanction announcements Mr. Chan went on to note that those involved in shipping containers across continents should be paying particular attention to the American sanction announcements. He commented: "Because almost all trans-Pacific trade moves over the ocean, we believe ocean container shipping will see the largest direct impact. But for shippers and retailers, there is no cheaper way to move goods than over the ocean, so there are few modal alternatives if production remains in Asia. We see the most risk for maritime shipping, with containers and dry bulk being more acute, with more insulation for oil and gas tankers." Shipping news and intelligence service Various sources have looked back on President Trump’s first term to get an idea of what could be expected As President Trump has just become his second term as US president and the American sanctions have only just been announced, it will take time to see what the true impact will be. However, various sources have looked back on President Trump’s first term to get an idea of what could be expected. For example, shipping news and intelligence service Lloyd’s List pointed out that tariffs introduced when President Trump was last in the White House had a noticeable effect on both spot container freight rates and import timing. Cargoes were pulled forward in the second half of 2018 by importers as they looked to beat tariff deadlines, which resulted in higher spot rates temporarily before affecting rates in 2019 because of inventory overhang. Could repeat results be seen across 2025 and 2026? Long-life inputs and goods from the tariff countries Jason Miller, a freight economist and professor of supply chain management at Michigan State University, certainly seemed to think so. Speaking to Lloyd’s List before President Trump’s 2024 presidential victory when the tariffs were only part of campaign proposals at that point, he said: “We will see front-loading like we have never seen before in 2025. There would be a massive pull-forward of demand as everybody rushes to bring in long-life inputs and goods from tariff countries, especially China.” Shipping demand and routes Shipping demand and routes could be affected due to trade uncertainty too Meanwhile, international shipping and forwarding agents Supreme Freight Services reported that increased tariffs may cause disruption to shipping volumes and global supply chains, if trade policies introduced by President Trump during his first term are anything to go by. Shipping demand and routes could be affected due to trade uncertainty too, though the publication also acknowledged that increased investment in ports and inland waterways across the US could improve efficiency for domestic and international trade alike. New American sanctions Cleveland Containers has looked to reassure its customers that any disruption caused by the new American sanctions will be minimised at the firm. Hayley Hedley, the company’s Commercial Director, stated: “Recent history certainly suggests that the new tariffs being introduced by President Trump will have various knock-on effects across the shipping industry." “Fortunately, Cleveland Containers has a continuous supply of shipping containers entering the UK. We work with several agents to ship from various locations, as well as having good stock on the ground, so are confident in our ability to provide for our customers.”

The shipping industry is currently navigating a profound transformation driven by environmental concerns, new emissions targets, and evolving regulations. As vessel owners and operators seek to reduce emissions while remaining competitive, determining the right strategy has become increasingly complex. Factors such as alternative fuel availability, fluctuating prices, and an ever-expanding range of technological solutions have made decision-making anything but straightforward. Lack of motivation Regulations evolve, technologies persist to advance, and can differ greatly from port to port The complexity arises from the many moving parts of the industry. Regulations evolve, technologies continue to advance, and infrastructure can differ greatly from port to port. For vessel owners committed to reducing their environmental impact, the challenge isn’t a lack of motivation, it’s finding the most effective way to navigate the myriad of options available. Hybrid propulsion systems One method gaining traction is data-driven decision-making through digital modelling. Rather than making decisions based on guesswork, digital modelling allows owners and operators to create a detailed representation of a vessel and simulate the performance of different strategies or technologies over its lifetime. That way, they can ‘test’ these approaches before committing large investments—particularly useful when considering new fuels or hybrid propulsion systems that are still maturing. Decarbonisation Modelling Service Digital modelling accounts for variables such as vessel speed, power needs, and route patterns Digital modelling accounts for variables such as vessel speed, power needs, and route patterns, applying machine-learning algorithms to find the most promising design or retrofit. It can also show how ideas might evolve if regulations tighten, or new fuels become more practical. At Wärtsilä, our Decarbonisation Modelling Service is designed to guide shipowners and operators through this maze of choices. In developing this tool, we have observed that shipowners required more than an “off-the-shelf” solution. They needed insights based on their own operational data, combined with practical knowledge of costs and likely regulatory trends. Benefits of digital modelling One of the main benefits of digital modelling is its flexibility. Depending on an owner’s goals, whether that’s meeting today’s regulations or planning for future mandates, they can explore multiple options. A fleet operator might compare installing hybrid batteries versus retrofitting for LNG or consider alternative fuels such as ammonia and methanol, or carbon capture. These simulations can factor in fuel prices, available bunkering infrastructure, and even unexpected events like global supply chain disruptions or future carbon taxes. Ship’s actual operational profile At Wärtsilä we often liken digital modelling as the closest thing to a crystal ball At Wärtsilä we often liken digital modelling as the closest thing to a crystal ball. While it isn’t perfect, it significantly improves our ability to make informed decisions and maintain flexibility as market conditions or regulatory landscapes shift. Consider, for instance, a mid-sized container ship operating in Asia. The owner, eager to lower CO2 emissions, might be unsure whether to retrofit for LNG immediately or wait for ammonia infrastructure to mature. Using a digital model based on the ship’s actual operational profile, we can test both scenarios—evaluating fuel price trends, port facilities, and the vessel’s remaining service life. Adopt an interim strategy If the model indicates that an LNG retrofit offers a promising return on investment along with moderate emissions cuts, the decision becomes clearer. Alternatively, if the potential for ammonia becomes evident sooner, it might be wiser to adopt an interim strategy or consider dual-fuel engines. It’s important to recognise that decarbonisation is not merely a box-ticking exercise to meet current regulations; it is a dynamic, ongoing process. With tightening rules from bodies like the International Maritime Organization (IMO) and the EU on carbon intensity, and with cargo owners increasingly demanding transparency, the need for adaptive, data-driven solutions is more critical than ever. LNG with battery storage Others might make quick retrofits to comply with rules and plan for bigger upgrades later Another strength of data-driven decarbonisation is that it is not a one-off activity. As a vessel operates, new information becomes available. Owners can update their models to reflect these shifts, allowing for continuous refinement. This matters because what is optimal now may only be a temporary measure. Some operators use LNG with battery storage for a few years, then switch to next-generation fuels as they become viable. Others might make quick retrofits to comply with regulations and plan for bigger upgrades later. Raw data into actionable insights There is also a perception that gathering and interpreting data is too complex or costly. However, many modern vessels are already equipped with the necessary sensors and tracking systems, and analytics software has become more accessible. The real value lies in transforming raw data into actionable insights. Digital models not only help in planning for evolving market conditions but also enable us to visualise and execute long-term strategies. Portion of global CO2 emissions The real test is balancing environmental aims with retail realities and regulatory forces Shipping contributes a notable portion of global CO2 emissions, giving the industry strong financial and ethical reasons to embrace cleaner operations. The real test is balancing environmental aims with commercial realities and regulatory pressures. With mounting pressure from regulators, customers, and investors, now is an opportune time to adopt data-driven approaches. A continuously updated model provides a practical way to keep up with changes in the market and policy landscape. By integrating operational data, anticipating possible scenarios, and remaining open to new solutions, the maritime industry can cut emissions without sacrificing competitiveness. Shipowners and operators Shipping is an industry that operates on tight margins and these tools must deliver financial stability as well as ongoing compliance. Digital modelling is not just another technical tool; it’s a forward-looking process that helps shipowners and operators steer a confident course in uncertain waters. As more companies experiment with alternative fuels, hybrid propulsion, and emerging technologies, having a robust method for evaluating these options is absolutely essential.