Decarbonisation

How to take the industry’s ‘ultimate planning tool’ and improve it? Giving users what they need, often before they know they need it, and staying ahead of evolving trends and regulations? Timo Essers, e-Navigation Director at NAVTOR, explains the philosophy driving the continual evolution of NavStation, while outlining the headline updates to the soon-to-be released NavStation 6.4. Navigators and shipping businesses "When you have products and services onboard over 18,000 ve...

Thetius, the globally renowned specialist maritime technology research firm, has partnered with specialist marketing and communications agency - Wake Media to deliver a unique service offering to its clients. The partnership creates an integrated, end-to-end research and communications service built on Thetius’ renowned expertise in market intelligence and Wake Media’s proven track record in powerful multi-channel campaign strategy and execution. Thetius and Wake Media partnership...

ClassNK has issued an approval in principle (AiP) for an Onboard Carbon Capture and Storage system (OCCS) developed by Mitsubishi Shipbuilding. The certification confirms its feasibility from regulatory and safety perspectives. Interest in CO2 capture the method from exhaust gases is growing alongside fuel conversion as part of efforts to reduce GHG emissions from ships. In response, the development of OCCS is progressing. Safety requirements for OCCS ClassNK will often strive to contribute t...

Brunvoll has signed a contract with Rizhao Gangda Shipyard for the delivery of an extensive propulsion, manoeuvring, and dynamic positioning system for an Emergency Towing Vessel (ETV). The vessel is owned by Smit Lamnalco, a subsidiary of Boskalis, and will operate for the Austral Maritime Safety Authority. Its mission is to protect the marine environment around the Great Barrier Reef and Torres Strait – some of the most precious marine areas in the world. Brunvoll twin-screw prop...

Sentinel Marine, a member of the Cyan Renewables Group, has signed a shipbuilding contract with Jiangmen Hangtong Shipbuilding Co., Ltd for the construction of a 65-metre multi-role energy support vessel to join their fleet, with options for a further three vessels. The new vessel will bring the fleet number to 15. The initial vessel in this innovative new class is scheduled for delivery in Q2 2027. The newbuild will be a DP2 vessel with a deadweight of 1,600 tonnes, with 375m² of clear de...

Fincantieri, a pioneer in complex shipbuilding, and Accenture, one of the world’s pioneering professional services companies, have signed an agreement to establish Fincantieri Ingenium, a new joint venture. The company will be owned 70% by Fincantieri NexTech – a subsidiary of the Fincantieri Group – and 30% by Accenture. The initiative stems from a Memorandum of Understanding signed in July 2024 and combines Fincantieri’s technological expertise in the naval sector...

News

Yanmar Power Technology Co., Ltd. (Yanmar PT), a subsidiary of Yanmar Holdings, has received an Approval in Principle (AiP) for its GH320FC Maritime Hydrogen Fuel Cell System from the classification society, DNV. The GH320FC is designed as a next-generation power source for marine applications with an innovative design that facilitates easy installation on various types of vessels. The system also allows for multiple units to be connected in parallel and offers flexibility in the number of hydrogen fuel cell modules, enabling it to meet diverse power requirements across different ship types and operations. GH320FC Maritime Hydrogen Fuel Cell System “We are excited about this new milestone in meeting our customers’ needs for sustainable clean energy solutions in the marine sector,” said Eric Tigelaar, Department Manager of the Commercial Marine Department at Yanmar Europe. Eric Tigelaar adds, “Our hydrogen fuel cell system is particularly well suited for applications, such as coastal passenger ferries, inland waterway cargo vessels, port service vessels and operations in low or zero emission zones across Europe.” Masaru Hirose, Director and General Manager of Large Power Products Business at Yanmar Power Technology Co., Ltd, stated: “This is a significant milestone in bringing our hydrogen fuel cell solutions to European customers. Drawing on our experience with previous installations, such as the hydrogen fuel cell system being used on a coastal passenger ferry currently in commercial operation in Japan, we believe our solutions can help the customers to achieve their decarbonisation goals.” Maritime industry pushes towards decarbonisation Olaf Drews, Head of Engines & Pressurised Equipment at DNV Maritime, remarked: “As the maritime industry pushes forward towards decarbonisation, we need to examine every option that offers full zero-emission operations. And fuel cells in combination with clean renewably produced fuels are a highly efficient and scalable power solution to meet this challenge.” Olaf Drews adds, “DNV is very pleased to award this AiP to Yanmar and to partner with such a future focused company to help set the stage for shipping’s next generation of vessels. We look forward to building on this great cooperation, working together to safely realise the benefits of this innovative technology for the maritime industry.”

Collaboration between countries and sectors needs to strengthen as the North Sea undergoes a period of diversification, according to a new report from DNV. North Sea Forecast: Ocean’s Future to 2050 estimates that offshore wind will claim 9% of the North Sea space by 2050, and policies to promote cross-industry collaboration are required to ease spatial planning pressure. The North Sea hosts Europe’s busiest ports, produces most of Europe’s offshore energy, and is the area with the biggest fisheries catch. Energy production from offshore oil DNV estimates that the area claimed from offshore wind alone will exceed 60,000 square kilometres in 2050 Offshore wind capacity in the North Sea is projected to grow six-fold by 2050, reaching 214 GW, which will be on par with energy production from offshore oil and gas. DNV estimates that the area claimed from offshore wind alone will exceed 60,000 square kilometres in 2050. In total, ocean infrastructure will occupy 23% of the North Sea area in 0–50 m water depth and 2–50 km from shore. Green energy ambitions While offshore wind is projected to grow, this is still not sufficient to meet the green energy ambitions of the Ostend Declaration for the North Sea. Supply chain bottlenecks on the maritime side need to be addressed. North Sea ports need to quadruple the capacity of facilities dedicated to offshore wind construction. There is also the need for more vessels to install and service the turbines. North Sea’s oil production North Sea’s oil production will decrease to 800,000 barrels per day in 2050, less than a fifth of now The North Sea’s oil production will decrease to 800,000 barrels per day in 2050, less than a fifth of what it is now. Gas has more staying power due to its strategic importance to Europe, with production forecast to reduce to 60 billion cubic metres per day, almost two-thirds less than in 2024. “The North Sea is central to Europe’s energy, food and supply chain security. Collaboration across borders and sectors is required to enhance security in the North Sea and to overcome challenges, such as ocean health, spatial competition and infrastructure for the offshore wind sector,” said Bente Pretlove, Director of Food and Ocean Systems at DNV. Demand for seafood and good management practices The North Sea will remain an important source of food. Due to an increased demand for seafood and good management practices, North Sea fisheries will be able to retain the same catch volumes as now. Norway and the UK will increase aquaculture output, but the majority of that growth will be in cooler waters further north. EU’s policies relating to marine spatial planning EU’s policies relating to marine spatial planning differs to that of both Norway and the UK The report highlights how five of the world’s ten pioneering maritime cities are situated on the North Sea which gives the region the infrastructure, financial power and expertise to deal with the challenges. However, there is a lack of policy standardisation which makes sustainable growth difficult. The EU’s policies relating to marine spatial planning differs to that of both Norway and the UK. As of now, only a few countries can claim to have integrated ecosystem-based management into their spatial planning. Transition to new energy systems Torgeir Sterri, Director Offshore Classification at DNV, said, "The North Sea is a shared and highly productive space that sits at the core of Europe's Blue Economy. Its evolving landscape demands closer coordination across borders and sectors. For the offshore industry, this means adapting to a more integrated approach to regulation, spatial planning, and technology." Torgeir Sterri adds, "Our mission is to support stakeholders in navigating this complexity and ensure safe operations, while facilitating the transition to new energy systems."

Technology group Wärtsilä has introduced a new methane slip reduction solution for its Wärtsilä 50DF dual-fuel engine. The new technology, which converts Wärtsilä 50DF dual-fuel (DF) engines to spark gas (SG) operation, enables a more optimised combustion process, thereby improving efficiency and lowering methane emissions. Wärtsilä 50DF engine Whilst operating on LNG, the new ‘Spark Gas Conversion for Wärtsilä 50DF’ is designed to reduce methane emissions up to 75 percent more than the standard Wärtsilä 50DF engine. The Spark Gas Conversion for Wärtsilä 50DF minimises methane emissions by introducing an electrically controlled pre-combustion chamber valve for a more optimised combustion process. Use of LNG and cutting methane emissions New solution reduces methane emissions down to 1.1 percent of fuel use The estimated result is that, on an IMO weighted (E2-cycle) average, the new solution reduces methane emissions down to 1.1 percent of fuel use. “The use of LNG and cutting methane emissions is one of the most effective ways to decrease overall greenhouse gas (GHG) emissions from marine engines over the next decade, complementing other efforts to reduce CO2 emissions,” comments Roger Holm, President of Wärtsilä Marine & Executive Vice President at Wärtsilä Corporation. “As the shipping industry strives for more sustainable operations, this new solution represents an important milestone on the road to advancing lower carbon fleets.” Chevron LNG Carriers The development of the solution, which consists of converting one-to-two of the total DF engines to SG, was made possible through extensive collaboration between Wärtsilä and Chevron Shipping Company. It was announced earlier that one engine on six Chevron LNG Carriers will be converted from DF to SG as part of Chevron’s aim to reducing the carbon intensity of its operations. Lower methane emissions The new solution is optimised for LNG as fuel, thus producing a better power work per unit of fuel The solution is now available to all vessels in the industry with existing Wärtsilä 50DF engines diesel-electric propulsion, the majority of which are LNG carriers. The new solution is optimised for LNG as fuel, therefore producing a better energy output per unit of fuel. This means fuel gas savings of up to 4.6 percent, as well as lower methane emissions. LNG-fuelled engines Holm continues: “Wärtsilä has an extensive track-record in reducing methane slip from LNG-fuelled engines, not only as newbuild solutions, but also through retrofitting existing installations. This latest technology complements our extensive portfolio of solutions aimed at reducing methane emissions from vessels.” With three decades of experience in LNG technology, Wärtsilä is providing market-pioneering performance-both with the dual fuel flexibility provided by the DF engine, as well as with the single fuel SG engine.

Hefring Marine, an Icelandic pioneer in intelligent marine technology, and Marine AI, a UK-based pioneer in autonomous vessel control systems, announced a new mutually beneficial partnership. This collaboration aims to enhance autonomous maritime operations by integrating Hefring Marine’s Intelligent Marine Assistance System (IMAS) with Marine AI’s GuardianAI autonomy suite. Hefring Marine’s IMAS Hefring Marine’s IMAS will complement GuardianAI’s existing capabilities by providing real-time insights This partnership sets the stage for seamless technological integration, where Hefring Marine’s IMAS will complement GuardianAI’s existing capabilities by providing real-time insights into sea conditions, optimising vessel operations, and improving safety. The collaboration will ensure that IMAS is fully compatible with the GuardianAI marine autonomy stack, with future plans to offer IMAS as an OEM-supported module within the GuardianAI suite. Integrating IMAS with GuardianAI “Our new venture with Marine AI is a great win for autonomous maritime technology,” said Karl Birgir Björnsson, CEO of Hefring Marine. “By integrating IMAS with GuardianAI, we are enabling vessels to operate more efficiently, safely, and with greater situational awareness. This partnership is a testament to our commitment to enhancing fleet intelligence and optimising maritime operations.” IMAS leverages AI technology Hefring Marine’s IMAS leverages AI technology, sensor data, and edge computing to insights Hefring Marine’s IMAS leverages AI technology, sensor data, and edge computing to deliver actionable insights, improving vessel efficiency, reducing fuel consumption, and enhancing onboard safety. Marine AI’s GuardianAI is a modular, state-of-the-art autonomous vessel control system capable of IMO Level 4+ autonomy, enabling high-fidelity situational awareness, tactical path routeing, and intelligent vessel control. How autonomous vessels interact with their environments “The synergy between GuardianAI and IMAS will redefine how autonomous vessels interact with their environments,” said Tom Rooney, general manager of Marine AI. “IMAS acts as the ‘human feel’ in an autonomous setting, allowing vessels to respond dynamically to real-time conditions. This partnership enables a holistic approach to autonomy, ensuring both crewed and uncrewed vessels can navigate safely and efficiently.” Focus on key maritime sectors Partnership will provide enhanced situational awareness and improved vessel in sea conditions This partnership will focus on key maritime sectors, including rescue operations, law enforcement, defense, offshore support, crew transfer and the leisure industry. By integrating IMAS within GuardianAI, the partnership will provide enhanced situational awareness and improved vessel survivability in various sea conditions. Capabilities of autonomous vessel operations Future plans include ongoing joint product development and system enhancements to expand the capabilities of autonomous vessel operations. The scalable nature of this technology means it can be applied across a broad spectrum of vessel types, from small uncrewed autonomous vessels to large passenger ships.

ABS Consulting has published an insightful new paper highlighting how aligning cybersecurity initiatives with key operational readiness principles enables organisations to develop a comprehensive strategy that enhances both operational resilience and guest safety. Maritime cybersecurity A Strategic Approach for the Cruise Industry, is the second in an industry-pioneering series on maritime cybersecurity that builds on ABS Consulting’s work supporting cruise clients’ safety commitment, cybersecurity resilience and sustainability reporting journeys. The paper details the importance of operationalising cybersecurity as a core component of maritime readiness and outlines a recommended approach to align cybersecurity initiatives with eight key operational principles, including human safety, marine resilience, guest services, and regulatory compliance. Integrating advanced technologies Integrating advanced technologies to enhance active efficiency and enrich guest affairs is crucial Cybersecurity is just one aspect of the risk management portfolio of services that ABS Consulting offers to the cruise industry. With digital transformation taking centre stage for cruise operators, integrating advanced technologies to enhance operational efficiency and improve guest experiences is crucial. Maritime cybersecurity series In addition to third-party operational technology (OT) cybersecurity assurance, ABS Consulting’s established body of work within the cruise industry includes risk assessments, safety management systems program development, feasibility studies and training, regulatory compliance, sustainability and asset lifecycle strategies, project due diligence, and HAZOP/HAZID workshops. Read ABS Consulting’s first report in its maritime cybersecurity series, Managing Maritime Cyber Risk – Rising to USCG’s New Maritime Security Directive on their website.

Cargotec Corporation has signed an agreement to sell its MacGregor business area to funds managed by Triton, for an enterprise value of EUR 480 million (“the Transaction”) to support Hiab’s future growth. Cargotec’s shareholders Transformation into a standalone Hiab is expected to take place on 1 April 2025. Cargotec’s transformation project, including listing Kalmar as a separate company, preparing Hiab for its standalone future and finding a solution for MacGregor, has progressed according to the plan and targets set by the Board in 2023. After considering different alternatives, the Board is convinced that from the value creation perspective, the Transaction represents the best alternative for Cargotec’s shareholders. Once the Transaction has been completed, Hiab would be the only business left in Cargotec and could pursue its strategy on a standalone basis. Cargotec’s Board of Directors Cargotec’s Board of Directors is planning to offer to Cargotec’s General Meeting of shareholders As the agreement to sell MacGregor has been signed, Cargotec’s Board of Directors is planning to propose to Cargotec’s General Meeting of shareholders that the company’s name would be changed from Cargotec to Hiab. Simultaneously as the name change enters into force, the current President and CEO of Cargotec, Casimir Lindholm, has announced his intention to step down as President and CEO after a successfully executed transformation project of the Cargotec group. Cargotec changes to transform into a standalone The Board of Directors would then appoint the President of the Hiab business, Scott Phillips, as the President and CEO of the renamed company being the current Cargotec. Cargotec currently estimates that these changes to transform into a standalone Hiab could take place on 1 April 2025. Current Cargotec CFO Mikko Puolakka would continue as CFO of the standalone Hiab. Closing of the transaction is expected to occur by 1 July 2025 MacGregor recorded sales of EUR 733 million and a comparable operating profit of EUR 33 million MacGregor is a pioneer in sustainable maritime cargo and load handling with a strong portfolio of products, services and solutions. In 2023, MacGregor recorded sales of EUR 733 million and a comparable operating profit of EUR 33 million. Triton is a pioneering European mid-market sector-specialist investor. Triton focuses on investing in businesses that provide mission-critical goods and services in its three core sectors of Business Services, Industrial Tech, and Healthcare. Triton has previous experience of investing in the maritime sector and is a proven pioneer in the practice of carve-out investments. MacGregor as a part of discontinued operations The enterprise value of the Transaction is EUR 480 million. Cargotec expects to record a tax-exempt loss of approximately EUR 200 million on the Transaction in the fourth quarter of 2024 results. The loss will be recorded as a goodwill impairment in items affecting comparability as a part of discontinued operations. Cargotec estimates that the total costs to separate MacGregor, in addition to the goodwill impairment, would be approximately EUR 25 million and recorded in items affecting comparability as a part of discontinued operations. MacGregor’s performance and market conditions Cargotec started the sales process of the business as MacGregor’s performance and market conditions The Transaction is subject to regulatory approvals and works council consultation in relevant jurisdictions. Closing of the Transaction is expected to occur by 1 July 2025 at the latest. In addition to funding Hiab’s growth, the Board evaluates using part of the proceeds from the Transaction to pay extra dividends. The sale of the business follows Cargotec’s Board of Directors' decision on 14 November 2022 that MacGregor will not be part of Cargotec’s portfolio in the future. However, from a value creation perspective, the timing for divesting the business was not ideal at the time. In May 2024, Cargotec started the sales process of the business as MacGregor’s performance and market conditions had clearly improved. Hiab’s ambitious growth plans “The agreement to sell MacGregor represents the last major milestone in our project to unlock shareholder value by separating Cargotec’s businesses into standalone companies. The two-year project has progressed according to our plan and is now in its final stages." "The proceeds from the Transaction will boost Hiab’s ambitious growth plans through innovation and M&A. MacGregor will become a strategic asset for its new owner who will develop and put full focus on the business, which will enable further growth and profitability improvement,” says Cargotec’s CEO Casimir Lindholm. Triton’s investment focus Cargotec will publish its reclassified financial data before the publication of its financial statements “MacGregor stands out due to its engineering capabilities; broad and sustainable product offering; high-quality equipment; and strong reputation. Triton looks forward to collaborating with the company and its employees to develop further on this market-pioneering position, especially by strengthening the aftermarket platform where we see great potential." "MacGregor is at the core of Triton’s investment focus to acquire market-pioneering companies with strong potential and a competitive edge,” says Ilkka Tuominen, Investment Advisory Professional at Triton. MacGregor will be reported as part of discontinued operations Due to the signing of the agreement to sell MacGregor, Cargotec will report the MacGregor business area as a part of discontinued operations from the fourth quarter of 2024 onwards. Cargotec will publish its reclassified financial information before the publication of its financial statements review for 2024. Updated outlook for 2024 Cargotec estimates Hiab’s comparable operating profit margin in 2024 to be above 14.0 percent Cargotec estimates Hiab’s comparable operating profit margin in 2024 to be above 14.0 percent. The business area 2024 profitability outlook is presented using the same principles that are applied in the 2023 external financial reporting. Background for the updated outlook The outlook for Hiab, which was specified on 23 October 2024, has not been amended. As the MacGregor will be reported as part of discontinued operations, the MacGregor business has been removed from Cargotec’s outlook for 2024. The losses which will be recorded as part of the Transaction does not impact Cargotec’s outlook.

Expert commentary

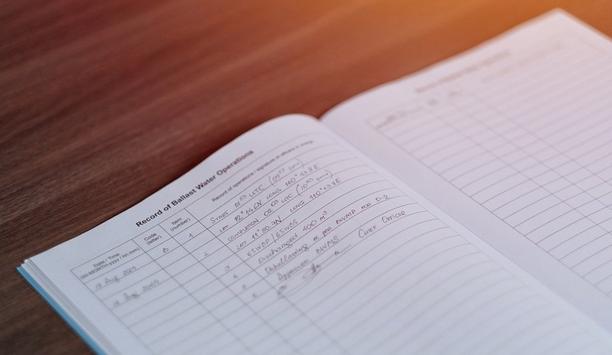

When the Ballast Water Management (BWM) Convention came into force in 2004, it was in response to a crisis we couldn’t afford to ignore—one where invasive aquatic species, carried silently in ships’ ballast tanks, were devastating marine ecosystems. Now, two decades later, compliance with this environmental safeguard is no longer optional—and yet, as recent industry findings reveal, record-keeping failures account for 58% of compliance issues. That’s not a technology problem. That’s a documentation problem —one rooted deeply in data management practices and crew training, where small oversights lead to documentation issues, that may cascade into costly compliance failures. And that’s precisely where digital systems excel, guiding crews clearly to avoid mistakes in the first place. New ballast regulations At the IMO’s 82nd Marine Environment Protection Committee (MEPC 82), new ballast water record-keeping regulations were approved, coming into effect from 1 February 2025. These updates mark a significant tightening of documentation standards—and they could catch unprepared shipowners off guard if not acted on promptly. Why ballast water record-keeping is back in the spotlight These new updates aim to change that—and they’re stricter, smarter, and more detailed than before While MEPC 82 made headlines for advancing decarbonisation policies and ECAs in the Arctic and Norwegian Sea, it also honed in on ballast water—a topic that has quietly regained importance. The committee approved critical updates to how ballast water operations and ballast water management system (BWMS) maintenance are recorded. The goal: Enhance transparency, reduce ambiguity, and reinforce environmental protection by making records more structured, traceable, and actionable. This renewed focus is both a warning and an opportunity. In recent years, too many Port State Control detentions and inspection delays have stemmed not from hardware failures, but from poorly maintained or unclear ballast water records. These new updates aim to change that—and they’re stricter, smarter, and more detailed than before. What’s changing: Bypass scenarios and maintenance logging The revised guidelines introduce two new scenarios for vessels dealing with challenging water quality (CWQ) in ports: Scenario 3: A reactive bypass of the BWMS due to unforeseen poor water quality. Scenario 4: A pre-emptive bypass based on anticipated CWQ conditions. These additions are essential for vessels operating globally, particularly those above 400GT. They ensure that alternative operations—like ballast water exchange plus treatment (BWE + BWT)—are clearly documented. Without accurate records, even legitimate actions can fall short of compliance. Ballast Water Management Plan and OEM manuals MEPC 82 also mandates that BWMS care procedures must now be recorded directly in BWRB MEPC 82 also mandates that BWMS maintenance procedures must now be recorded directly in the Ballast Water Record Book (BWRB), in line with the ship’s Ballast Water Management Plan and Original Equipment Manufacturer (OEM) manuals. Responsible crew members must sign off on these records, ensuring traceability and crew accountability. This step isn’t just regulatory housekeeping—it aligns ballast water maintenance with how other onboard systems are already tracked, from engines to emissions. It’s a logical, overdue move toward consistency across compliance. Paper or digital: The format dilemma While the BWRB can still be maintained on paper or electronically, the burden of new structured data fields and stricter reporting timelines will be felt most by those still tied to manual systems. Each additional layer of documentation increases the chance of human error—and with nearly 6 in 10 compliance failures already stemming from admin issues, that’s a risk many operators can’t afford. This is where digital solutions can offer real relief. At NAPA, we’ve already implemented the latest IMO guidelines into our electronic logbook, so crews can comply with MEPC.369(80) requirements out of the box. With ready-made entry templates and smart input validation, data entry is quick, accurate, and audit-ready. NAPA implemented the latest IMO guidelines into an electronic logbook. Better still, once updated, operators can apply for the BWM Convention Electronic Record Book Declaration from their flag—ensuring that compliance is recognised internationally under MEPC.372(80). Less admin, more assurance Electronic logbooks don’t just streamline compliance—they enable better decision-making. When connected to onboard systems, they automatically pull operational data into the BWRB, reducing manual work and error margins. This frees up the crew to focus on operations and safety, rather than paperwork. From a management perspective, real-time visibility into ballast operations and maintenance records helps shore teams stay ahead of inspections and identify potential compliance gaps early. One logbook, many regulations While ballast water is the focus today, it’s not the only regulation demanding attention While ballast water is the focus today, it’s not the only regulation demanding attention. At NAPA, we’ve designed our logbook to support a wide range of evolving compliance frameworks—including MARPOL, EU-ETS, EU-MRV, CII, and the Garbage Record Book. This unified approach removes silos, reduces duplicated effort, and gives operators a more holistic view of vessel performance and compliance. A smarter way forward With decarbonisation and environmental regulations shifting at breakneck pace, even the most experienced crews and fleet managers can struggle to stay up to date. That’s where technology has a crucial role to play—not to replace expertise, but to support it. At NAPA, we work closely with shipowners and operators to configure regulatory record book templates according to their fleet workflows and each vessel’s specific operational profile. This ensures accuracy, ease of use, and most importantly, continuous compliance—even as the rules keep changing. Because in today’s compliance landscape, staying ahead isn’t just about meeting the minimum. It’s about building systems that help you adapt, respond, and thrive. And that starts with getting the record-keeping and data management right.

The shipping industry is currently navigating a profound transformation driven by environmental concerns, new emissions targets, and evolving regulations. As vessel owners and operators seek to reduce emissions while remaining competitive, determining the right strategy has become increasingly complex. Factors such as alternative fuel availability, fluctuating prices, and an ever-expanding range of technological solutions have made decision-making anything but straightforward. Lack of motivation Regulations evolve, technologies persist to advance, and can differ greatly from port to port The complexity arises from the many moving parts of the industry. Regulations evolve, technologies continue to advance, and infrastructure can differ greatly from port to port. For vessel owners committed to reducing their environmental impact, the challenge isn’t a lack of motivation, it’s finding the most effective way to navigate the myriad of options available. Hybrid propulsion systems One method gaining traction is data-driven decision-making through digital modelling. Rather than making decisions based on guesswork, digital modelling allows owners and operators to create a detailed representation of a vessel and simulate the performance of different strategies or technologies over its lifetime. That way, they can ‘test’ these approaches before committing large investments—particularly useful when considering new fuels or hybrid propulsion systems that are still maturing. Decarbonisation Modelling Service Digital modelling accounts for variables such as vessel speed, power needs, and route patterns Digital modelling accounts for variables such as vessel speed, power needs, and route patterns, applying machine-learning algorithms to find the most promising design or retrofit. It can also show how ideas might evolve if regulations tighten, or new fuels become more practical. At Wärtsilä, our Decarbonisation Modelling Service is designed to guide shipowners and operators through this maze of choices. In developing this tool, we have observed that shipowners required more than an “off-the-shelf” solution. They needed insights based on their own operational data, combined with practical knowledge of costs and likely regulatory trends. Benefits of digital modelling One of the main benefits of digital modelling is its flexibility. Depending on an owner’s goals, whether that’s meeting today’s regulations or planning for future mandates, they can explore multiple options. A fleet operator might compare installing hybrid batteries versus retrofitting for LNG or consider alternative fuels such as ammonia and methanol, or carbon capture. These simulations can factor in fuel prices, available bunkering infrastructure, and even unexpected events like global supply chain disruptions or future carbon taxes. Ship’s actual operational profile At Wärtsilä we often liken digital modelling as the closest thing to a crystal ball At Wärtsilä we often liken digital modelling as the closest thing to a crystal ball. While it isn’t perfect, it significantly improves our ability to make informed decisions and maintain flexibility as market conditions or regulatory landscapes shift. Consider, for instance, a mid-sized container ship operating in Asia. The owner, eager to lower CO2 emissions, might be unsure whether to retrofit for LNG immediately or wait for ammonia infrastructure to mature. Using a digital model based on the ship’s actual operational profile, we can test both scenarios—evaluating fuel price trends, port facilities, and the vessel’s remaining service life. Adopt an interim strategy If the model indicates that an LNG retrofit offers a promising return on investment along with moderate emissions cuts, the decision becomes clearer. Alternatively, if the potential for ammonia becomes evident sooner, it might be wiser to adopt an interim strategy or consider dual-fuel engines. It’s important to recognise that decarbonisation is not merely a box-ticking exercise to meet current regulations; it is a dynamic, ongoing process. With tightening rules from bodies like the International Maritime Organization (IMO) and the EU on carbon intensity, and with cargo owners increasingly demanding transparency, the need for adaptive, data-driven solutions is more critical than ever. LNG with battery storage Others might make quick retrofits to comply with rules and plan for bigger upgrades later Another strength of data-driven decarbonisation is that it is not a one-off activity. As a vessel operates, new information becomes available. Owners can update their models to reflect these shifts, allowing for continuous refinement. This matters because what is optimal now may only be a temporary measure. Some operators use LNG with battery storage for a few years, then switch to next-generation fuels as they become viable. Others might make quick retrofits to comply with regulations and plan for bigger upgrades later. Raw data into actionable insights There is also a perception that gathering and interpreting data is too complex or costly. However, many modern vessels are already equipped with the necessary sensors and tracking systems, and analytics software has become more accessible. The real value lies in transforming raw data into actionable insights. Digital models not only help in planning for evolving market conditions but also enable us to visualise and execute long-term strategies. Portion of global CO2 emissions The real test is balancing environmental aims with retail realities and regulatory forces Shipping contributes a notable portion of global CO2 emissions, giving the industry strong financial and ethical reasons to embrace cleaner operations. The real test is balancing environmental aims with commercial realities and regulatory pressures. With mounting pressure from regulators, customers, and investors, now is an opportune time to adopt data-driven approaches. A continuously updated model provides a practical way to keep up with changes in the market and policy landscape. By integrating operational data, anticipating possible scenarios, and remaining open to new solutions, the maritime industry can cut emissions without sacrificing competitiveness. Shipowners and operators Shipping is an industry that operates on tight margins and these tools must deliver financial stability as well as ongoing compliance. Digital modelling is not just another technical tool; it’s a forward-looking process that helps shipowners and operators steer a confident course in uncertain waters. As more companies experiment with alternative fuels, hybrid propulsion, and emerging technologies, having a robust method for evaluating these options is absolutely essential.

Maritime communications came a long way before they could deliver the first Global Maritime Distress and Safety System (GMDSS). Still, it is fair to say that their forward march has only accelerated in the two-and-a-half decades since. Today, shipping companies rely on satellite connectivity to protect their vessels and people and enable the digitalisation, decarbonisation, and crew-welfare initiatives on which its successes rely. Low-Earth orbit (LEO) networks Against this background, the new generation of low-Earth orbit (LEO) networks has entered the maritime market to great fanfare and expectation from ship owners, and their excitement is justified: LEO satellite coverage has the potential to span the globe, providing exceptional reliability and speed even during long voyages in the most remote locations. This facilitates real-time communication and efficient coordination between vessels and onshore personnel, ultimately supporting more profitable and sustainable fleet operations. Level of connectivity Moral obligations and regulatory requirements aside, providing high-quality crew internet LEO’s introduction into the maritime sphere has been equally well received by seafarers, who stand to benefit from a level of connectivity that keeps them better connected to family and friends than ever before, and to richer entertainment options at sea. Moral obligations and regulatory requirements aside, providing high-quality crew internet represents a wise investment from a competitive standpoint, enhancing as it does an organisation’s ability to attract and retain the brightest talent. Another advantage to seafarers and their employers, LEO connectivity offers stable onboard access to non-leisure services including mental-health support, telemedicine, and online learning resources, helping to keep a crew happy, healthy, and up to speed with the evolving requirements of their job. Limitations For all the benefits of LEO networks, it is important to acknowledge their limitations. For instance, LEO’s promise of delivering worldwide coverage remains to be realised, with certain countries yet to authorise its use in their territorial waters. This means that, depending on the trading route, a ship may encounter multiple LEO-coverage blackspots during its voyage. Susceptible to interference Regardless of the network type being used, vessels still need to compress and throttle data Like many satellite technologies, LEO networks are also susceptible to interference from atmospheric conditions that can disrupt communications, while network congestion at hotspots and drop-out at satellite handover may present additional connectivity challenges. Regardless of the network type being used, vessels still need to compress and throttle data on certain occasions, such as while in port, but LEO networks currently cap utilisation and therefore limit connectivity and availability further. Crew and commercial use In addition, maritime organisations should consider whether their LEO system is for both crew and commercial use. For a vessel deploying LEO connectivity to cover crew and business communications simultaneously, even a terabyte of data is unlikely to go far. Divided among a crew of 25, it equates to 40 gigabytes per person, enough for 13 hours of HD streaming with nothing remaining for commercial requirements. The solution Maritime software including critical communications-based services will need to be compatible with LEO To ensure reliable and consistent connectivity, support enhanced GMDSS communications, and meet the bandwidth needs of all stakeholders, a vessel will require multiple satellite provisions. This means that maritime software including critical communications-based services will need to be compatible with both LEO and more traditional, low-bandwidth networks and be able to switch between connections automatically to ensure uninterrupted service. GTMailPlus GTMaritime’s GTMailPlus, for example, is compatible with all major network types, regardless of bandwidth. Developed with optimisation in the maritime environment in mind, it provides secure and efficient data transfers irrespective of the service or combination of services a shipowner or manager uses. If disruptions do occur, GTMailPlus resumes data transmission from the point of interruption. Risk of a cybersecurity breach There have already been several reported cases of ship owners falling victim to significant cyber incidents As crew freedoms on the Internet increase and more onboard devices are connected to the network, the risk of breaches to cybersecurity is also rising dramatically: effectively, the vessel becomes a larger attack surface. There have already been several reported cases of ship owners falling victim to significant cyber incidents having adopted LEO systems without taking the necessary security precautions. Robust, intelligent, and scalable network Given that ships transfer diverse types of data that often involve critical and sensitive information, the consequences of any breach of vessel operations, safety, and privacy can be severe. Here too, the GTMaritime portfolio is continuously evolving to ensure robust, intelligent, and scalable network protection for owners. AI-based next-gen anti-virus technology In addition to the enhanced security features included in all GTMaritime solutions, enables a holistic approach In the latest partnership with CrowdStrike, GTMaritime’s cyber-security offering combines AI-based next-generation anti-virus technology with end-point detection and response capabilities. This, in addition to the enhanced security features included in all GTMaritime solutions, enables a holistic approach to vessel security. Conclusion LEO networks undoubtedly present a considerable opportunity for the maritime industry and have the power to transform connectivity at sea. However, there are several factors to consider before adopting an LEO system and regardless of advances in technology, optimised solutions for critical communications, security, and data transfer remain essential.

Harbour insights

Ammonia is gaining traction as a future fuel in the maritime industry, primarily due to its potential to significantly reduce greenhouse gas emissions. A key driver for ammonia's interest is that it can be carbon-free when combusted, which aligns with the maritime industry's increasing pressure to meet emissions regulations. However, most ammonia production currently relies on fossil fuels. Transitioning to "green ammonia" production is crucial for sustainability. If "green ammonia" is produced using renewable energy sources, it offers a pathway to near-zero emissions shipping. Safety measures and regulations Ammonia’s volumetric energy density – higher than hydrogen – makes it more practical for onboard storage. However, ammonia is toxic, which requires stringent safety measures and regulations for handling and storage. The combustion of ammonia can produce nitrous oxide (N2O), a potent greenhouse gas. Therefore, mitigation technologies are needed. Building the necessary infrastructure for ammonia bunkering and supply will be a significant undertaking. Developing guidelines for safe use Ammonia is poised to play a significant role in the maritime industry's transition to a future The International Maritime Organization (IMO) is developing guidelines for the safe use of ammonia as a marine fuel. Increasing numbers of companies are investing in the development of ammonia-fueled vessels and technologies. European Union (EU) legislation, such as the EU Emissions Trading System (ETS) and the FuelEU initiative to support decarbonisation, are pushing the maritime industry towards the use of alternative fuels, which is increasing the potential of ammonia. While challenges remain, ammonia is poised to play a significant role in the maritime industry's transition to a more sustainable future. Ongoing research and development Ongoing research and development are focused on improving safety, reducing emissions, and scaling up production. In essence, ammonia offers a promising pathway for the maritime industry to reduce its carbon footprint, but its widespread adoption depends on overcoming technical and logistical challenges. Working toward the future of ammonia Progress is already happening as the maritime industry works toward a future that includes the use of ammonia as a fuel. For example, one project underway aims to be a pioneer in establishing a comprehensive and competitive supply chain to provide clean ammonia ship-to-ship bunkering in the U.S. West Coast. Progress is already occurring as the maritime industry works toward a future A feasibility study is being conducted at the Port of Oakland, Benicia, and nearby major ports on the U.S. West Coast. A Memorandum of Understanding (MOU) between American Bureau of Shipping, CALAMCO, Fleet Management Limited, Sumitomo Corp. and TOTE Services LLC is jointly conducting the feasibility study. "We are proud to share our industry-pioneering expertise in ammonia as a marine fuel to support this study on the U.S. West Coast,” said Panos Koutsourakis, Vice President of Global Sustainability at the American Bureau of Shipping. “Our expertise in developing safety guidelines will support the consortium to address the ammonia-specific set of safety and technology challenges.” More global ammonia developments In another development, three LPG/ammonia carrier ships have been ordered at the South Korean shipyard HD Hyundai Heavy Industries (HD HHI). Danish investment fund European Maritime Finance (EMF) and international shipping company Atlas Maritime have confirmed the order. HD HHI’s parent company, HD Korea Shipbuilding & Offshore Engineering (HD KSOE), revealed the order for $372 million in March 2024. The three 88,000 cubic-metre LPG dual-fuel carriers, capable of carrying and running on ammonia, are scheduled for delivery in December 2027. The vessels will be named EMF Viking I, II, and III. Also, Lloyd’s Register (LR) and Guangzhou Shipyard International have signed a joint development project to design the world’s largest very large ammonia carrier (VLAC). The design of the 100,000-cubic-metre vessel has been assessed in line with LR’s Structural Design Assessment and prescriptive analysis. The gas carrier will have an independent IMO Type B tank for safe carriage of the chemical. Zero-emissions operations The cargo ship, which will be 7,800 dwt, is designed to transport timber from Norway to Europe “As major economies look to co-fire ammonia in their coal power stations to reduce the CO2 footprint of their national energy mix, shipping will play a key role in distributing clean hydrogen-based commodities such as ammonia, thereby supporting nations to meet their Paris Agreement commitments," says LR's Chief Executive Nick Brown. Furthermore, a partnership of companies from Norway has ordered a pioneering short-sea cargo ship that will advance the industry’s ability to provide zero-emissions operations. The cargo ship, which will be 7,800 dwt, is designed to transport timber from Norway to Europe and will be the first to operate on ammonia and electricity. Amogy’s ammonia-to-electrical power system A start-up company focusing on ammonia-to-power technology, Amogy, demonstrated the first tugboat powered by its cracking technology just short of the fourth anniversary of the company’s launch. The trip of a 67-year-old tug along a tributary of New York State’s Hudson River is part of the company’s works to develop and commercialise its technology to decarbonise the most difficult industries. Amogy’s ammonia-to-electrical power system splits, or “cracks,” liquid ammonia into its base elements of hydrogen and nitrogen. The hydrogen is then funnelled into a fuel cell, generating the power for the vessel. Research points to the risks of ammonia The chemical, made of hydrogen and nitrogen, can also be burned as a zero-carbon fuel Today and in the future, ammonia, a main component of many fertilisers, can play a key role in a carbon-free fuel system as a convenient way to transport and store clean hydrogen. The chemical, made of hydrogen and nitrogen, can also be burned as a zero-carbon fuel. However, new research led by Princeton University scientists illustrates that even though it may not be a source of carbon pollution, ammonia's widespread use in the energy sector could pose a grave risk to the nitrogen cycle and climate without proper engineering precautions. Use of ammonia U.S. National Science Foundation (NSF)-supported research found that a mismanaged ammonia economy could ramp up emissions of nitrous oxide, a long-lived greenhouse gas around 300 times more potent than carbon dioxide and a major contributor to the thinning of the stratospheric ozone layer. The use of ammonia could lead to substantial emissions of nitrogen oxides, a class of pollutants that contribute to the formation of smog and acid rain. And it could directly leak fugitive ammonia emissions into the environment, forming air pollutants, impacting water quality and stressing ecosystems by disturbing the global nitrogen cycle. Negative impacts of an ammonia economy The researchers found that the potential negative impacts of an ammonia economy "We have great hope that ingenuity and engineering can help reduce our use of carbon-based energy sources," said Richard Yuretich, a program director in NSF's Division of Earth Sciences. "But caution is advised because of unintended environmental spillover effects that may result from new technology." The researchers found that the potential negative impacts of an ammonia economy may be minimised with proactive engineering practices, but the possibility of risks should not be taken lightly. Addressing an inconvenient reality As interest in hydrogen as a zero-carbon fuel has grown, so too has an inconvenient reality: It is notoriously difficult to store and transport over long distances, requiring storage at either temperatures below -253 degrees Celsius or at pressures as high as 700 times atmospheric pressure. Ammonia, on the other hand, is much easier to liquify, transport and store, and capable of being moved around similarly to tanks of propane. Nonetheless, the cycle of nitrogen is delicately balanced in Earth's critical zone, and extensive research must be undertaken to investigate the repercussions of ammonia combustion and to develop new methods to minimise the risks. Challenges of ammonia as a maritime fuel Here's a breakdown of the key challenges of using ammonia for maritime fuel: Toxicity and Safety: For human health, ammonia is highly toxic, posing a serious risk to human health through inhalation or skin contact. This necessitates stringent safety protocols, advanced leak detection systems, and thorough crew training. Relating to the environment, leaks can also harm aquatic ecosystems, requiring robust containment and mitigation measures. Combustion Challenges: Ammonia's combustion characteristics are less favourable than traditional fuels, requiring modifications to engine design and potentially the use of pilot fuels. Emissions: Combustion can produce nitrogen oxides (NOx) and nitrous oxide (N2O), both of which are harmful pollutants. Mitigating these emissions is crucial. "Ammonia slip" is also a concern, in which unburnt ammonia is released. Infrastructure and Supply Chain: Establishing a global network of ammonia bunkering infrastructure is a massive undertaking, requiring significant investment and coordination. Scaling up "green ammonia" production, using renewable energy, is essential for its sustainability. This requires a robust and reliable supply chain. Storage: Ammonia has specific storage requirements, and onboard storage systems must be designed for safety and efficiency. International Standards Needed: Consistent and comprehensive international regulations and standards are needed for the safe handling, transportation, and use of ammonia as a marine fuel. While the IMO is developing Guidelines, complete and ratified rules are still needed. Economic challenges: "Green ammonia" is currently more expensive than traditional fuels, although costs are expected to decrease as production scales up. Significant investments are needed in research, development, and infrastructure to make ammonia a viable maritime fuel. Also, dedicated ammonia-fueled engines are still under heavy development, and do not have widespread availability. The path to commercialisation Overcoming the variety of technical and other obstacles will require collaboration among governments, industry stakeholders, and research institutions. The timeline for ammonia deployment in maritime applications is actively unfolding, with key milestones happening now and soon. 2025 marks the first trials of two-stroke, ammonia dual-fuel engines on oceangoing ships. Engine manufacturers like MAN Energy Solutions and WinGD are progressing with their engine development, with initial deliveries soon. These pilot projects are crucial for gathering real-world data and building confidence in ammonia as a marine fuel. Development of comprehensive regulations As the maritime industry faces, ammonia is hoped to play a growing role in the fuel mix Gradual commercialisation will follow in the late-2020s as the technology matures and the infrastructure develops. The focus will be on refining engine technology, improving safety protocols, and establishing bunkering facilities in key ports. Wider adoption will likely follow in the 2030s, depending on factors such as the cost of green ammonia, the development of comprehensive regulations, and the expansion of the global supply chain. As the maritime industry faces increasing pressure to decarbonise, ammonia is expected to play a growing role in the fuel mix. Future of maritime It's likely that a combination of ammonia and other alternative fuels and technologies will be used in the future of maritime. Alternatives include methanol, liquid natural gas (LNG), hydrogen, biofuels, electric propulsion, and even nuclear power. Ammonia is a strong contender, bit it faces stiff competition from other promising technologies. The maritime industry's transition to a sustainable future will likely involve a diverse mix of fuel solutions.

The Dark Fleet refers to a network of vessels that operate outside of standard maritime regulations, often used to transport sanctioned goods such as oil. These shadowy vessels are also referred to by terms such as Parallel Fleet and/or Shadow, Gray or Ghost fleet. The terms are all manifestations of the same thing – ships that are owned, structured, and operated to avoid exposure to sanctions. Fleet of ships “In fact I would prefer that we use the term Parallel Fleet because it more accurately describes what it is,” says Mike Salthouse, Head of External Affairs, of NorthStandard, a Protection and Indemnity (P&I) insurer. “Specifically, it is a fleet of ships operating in parallel to mainstream shipping while avoiding use of service providers that are subject to sanctions legislation.” Modern shipping sanctions Sanctions were to be enforced not just against the sanctions-breaking vessel but also the services Modern shipping sanctions can be traced back to the introduction of the U.S. Comprehensive Iran Sanctions Accountability and Divestment Act 2010 or “CISADA”. Under CISADA for the first time, sanctions were to be enforced not just against the sanctions-breaking vessel but also the services (for example insurance, class, flag, banks) that the vessel used. EU/G7 Coalition adopting sanctions As a result, all maritime service providers sought to distance themselves and introduce contractual termination clauses in their service contracts forcing such vessels to either trade without such services or to access them from non-sanctioning jurisdictions. This led immediately to the creation of mainly Iranian ships that could continue to carry cargoes subject to western economic sanctions – such as Iranian oil. However, the fleet has grown exponentially following the EU/G7 Coalition adopting sanctions targeting Russian shipping. Today the majority (but not all) of the Dark Fleet is engaged carrying Russian cargoes – but other trades include Iran, North Korea, and Venezuela. Protection of the marine environment Dark Fleet undermines transparent governance policies that ensure the welfare and safety “It might be that a removal of Russian sanctions would remove the need for such a fleet,” adds Salthouse. “But for so long as nations use maritime sanctions as a foreign policy tool, my own view is that the Dark Fleet phenomenon will continue to facilitate sanctioned trades.” The Dark Fleet undermines transparent governance policies that ensure the welfare and safety of those on board and the protection of the marine environment. In recent years, the safety of tankers has improved significantly. These improvements have been driven by factors such as greater operational oversight from the oil majors, younger double hull vessels, greater operational scrutiny, and more rigorous legislation. Safety has been prioritised over all else. Transport oil using ships and services “The commercial dynamics that apply to the Dark Fleet are very different,” says Salthouse. “The overwhelming commercial imperative is not safety but to transport oil using ships and services to which sanctions legislation does not apply. As such, the customer and regulatory oversight is much reduced.” The vessels used by the Dark Fleet also tend to be older. Even if it were possible to find shipyards that were prepared to build for use carrying sanctioned cargoes (and so risk secondary sanctions depriving them of access to western financial markets and insurers), the long build times mean that such ships would not become available for several years. As such, the vessels that comprise the Dark Fleet tend to be end-of-life and aged 15 years or older. Commercial reinsurance markets The insurers of the ship will likely have been unable to access commercial reinsurance markets used If and when an accident happens, the ability of the insurer to respond by using commercial salvors and pollution responders will be curtailed by sanctions legislation, and the insurers of the ship will likely have been unable to access commercial reinsurance markets commonly used to access the high levels of cover required to fully compensate victims. Sanctioning individual ships is an effective way of addressing the Dark Fleet because shipping that trades internationally invariably needs access to western financial and service markets, which a designation deprives them of. Collaboration with mainstream shipping EU/G7 Coalition States to date have designated over 100 vessels, but in practical terms, the Dark Fleet is much larger than this – somewhere in the region 600 to 1000 vessels – so more needs to be done, says Salthouse. Thought also needs to be given as to how to dispose of old designated tonnage (as designation will prevent scrapping) whilst at the same time addressing the supply side so that designated ships cannot simply be replaced. “That can only be achieved in collaboration with mainstream shipping which should be consulted and partner with governments to achieve their aim,” says Salthouse. Majority of shipowners and service Dark Fleet will thrive for so long as maritime sanctions are deployed by states as a means of foreign policy goals Without concerted state action delving with the existing fleet and its access to new ships, the Dark Fleet will thrive for so long as maritime sanctions are deployed by states as a means of achieving their foreign policy goals. The cost of compliance to mainstream shipping is huge. The vast majority of shipowners and service providers deploy significant resources to avoid inadvertently contravening applicable sanctions. EU/G7 Coalition partners should recognise that and work with the shipping industry to marginalise the commercial space served by the Parallel/Dark Fleet rather than simply imposing ever greater and more complex compliance requirements, comments Salthouse. Use of EU/G7 Coalition service In a majority of cases, the Parallel Fleet is not breaking any laws. With the exception of the UN sanctions programme directed at North Korea, the Parallel/Dark Fleet can trade perfectly lawfully. For example, it is not illegal for a Russian flagged ship, insured in Russia, classed in Russia and trading with non-EU/G7 Coalition partners to transport Russian oil sold above the price cap through international waters to non-EU/G7 Coalition states provided the trade does not make use of EU/G7 Coalition service providers. Use of established service providers The Parallel/Dark Fleet is bad for shipping and undermines EU/G7, and on occasions, UN sanctions programmes, says Salthouse. States cannot control a trade when the ships carrying the cargoes and the service providers involved are not subject to the jurisdiction of that State. Similarly, when ships sink and cause pollution, the whole shipping industry suffers by association, and the additional complexities involved in responding to a casualty that cannot make use of established service providers could make a bad situation much worse.

Carbon capture and storage (CCS) can contribute to decarbonisation of the maritime industry, especially when combined with other approaches. CCS allows ships to continue using fossil fuels while capturing and storing the emitted CO2. It’s a helpful interim approach if a vessel’s immediate transition to alternative fuels is not feasible due to infrastructure limits or technology constraints. CCS can extend a vessel’s operational lifespan, both reducing emissions from existing vessels while avoiding premature scrapping and associated environmental impacts. Technology challenges There are technology challenges, such as higher fuel consumption and process costs for ships As the industry works toward the use of zero-emission fuels such as green hydrogen, ammonia and methanol, CCS offers a more gradual and realistic pathway to decarbonisation. CCS is also an attractive option for long-haul shipping routes where alternative fuel infrastructure may be limited. However, there are technology challenges, such as higher fuel consumption and operation costs for ships. Space constraints are another obstacle considering the needs to operate and install CCS equipment on board ships. Clear and supportive regulation More work is needed to provide secure and reliable long-term storage of captured CO2, which is still under development. Technology advancement and government incentives are also needed to increase the economic viability of Carbon Capture and Storage for ships operators. Clear and supportive regulation paves the way for widespread adoption of CCS in the maritime sector, including standards for capture, transport, and storage. Carbon capture and storage The amine solution, now loaded with CO2, is then sent to a regenerator (stripper) In a CCS system, carbon dioxide (CO2) is captured from a ship’s exhaust gases after the fuel has been burned. This often involves chemical absorption, in which the exhaust gases pass through a solvent that absorbs the CO2. A contactor (absorber) uses an amine solution to react chemically with the CO2, forming a carbamate compound. This effectively removes the CO2 from the flue gas. The amine solution, now loaded with CO2, is then sent to a regenerator (stripper). Heat is applied to the solution, causing the carbamate to decompose, releasing the captured CO2. Onshore storage sites The CO2 is then separated and stored onboard in high-pressure tanks as a liquid, and later offloaded at designated ports for transport to onshore storage sites. There is an energy penalty in the process, since CCS itself requires energy, which can increase fuel consumption and operating costs for the ship. Because onboard storage capacity for captured CO2 can be limited, frequent offloading is required. Adoption timeline for CCS Most CCS projects in the maritime sector are still in the research and development phase In the near term (5 to 10 years), initial deployments of CCS on select vessels will likely focus on niche applications or specific routes. Most CCS projects in the maritime sector are still in the research and development phase. Some pilot projects and demonstrations are underway to test the feasibility and effectiveness of CCS technologies, but large-scale commercial deployments of CCS systems on board ships are still to come. If technological advancements and economic viability improve, CCS could see more widespread adoption in the maritime sector within the next 10 to 20 years, particularly for vessels where alternative fuel options are limited or not yet feasible. The development of a robust infrastructure for the transport and storage of captured CO2 will be crucial for the large-scale deployment of CCS in the maritime. Requirements of CCS systems for maritime use Looking long-term (20 years or more), CCS could become a mature technology integrated into the broader maritime decarbonisation landscape, potentially playing a role alongside other technologies like alternative fuels and energy efficiency measures. Continued research and development will aim to improve the efficiency, cost-effectiveness, and space requirements of CCS systems for maritime use. The development of more efficient and compact CCS systems is crucial for their widespread adoption in the maritime sector. Reducing the costs, including capital expenditures and operational expenses, is also essential. Clear and supportive regulations, including carbon pricing mechanisms and incentives for CCS deployment, will encourage its adoption. Complementary technologies toward decarbonisation Another option is using fuel cells to convert hydrogen or other fuels into electricity for propulsion CCS can be used in conjunction with transitional fuels like Liquefied Natural Gas (LNG), capturing and storing CO2 emissions from LNG-powered vessels to reduce the carbon footprint while the industry transitions to zero-emission fuels. CCS can be particularly valuable for sectors where zero-emission alternatives may not be readily available or feasible, such as long-haul shipping. CCS can also serve as a backstop technology, providing a potential solution for residual emissions from alternative fuel pathways, even if they are considered low-carbon. A range of alternative fuel scenarios drive research and development into new technologies such as biofuels, green hydrogen, ammonia, and methanol. Another possibility is using fuel cells to convert hydrogen or other fuels into electricity for propulsion. Better battery technology, including better capacity and charging infrastructure, is needed. And ship designs must be optimised for alternative fuels, including storage and handling systems. Next stages for CCS The next stage in the development of carbon capture and storage (CCS) for maritime vessels will likely involve full-scale demonstration projects, moving beyond small-scale prototypes and lab tests to real-world applications on commercial vessels. More compact and lightweight systems will be developed to reduce the weight and space requirements on board ships. Viable business models and financial mechanisms are needed to make CCS economically attractive for ship owners. A clear and consistent regulatory framework can incentivise CCS adoption and ensure compliance with environmental standards. There also needs to be more public awareness and understanding of the role of CCS in decarbonising the maritime sector.

Case studies

Strengthening trade relations and promoting collaboration between Valenciaport and China. This is the objective with which the Port Authority of València has traveled to China to participate in the 8th edition of the Maritime Silk Road Port International Cooperation Forum 2024, held from June 26 to 28, 2024 in Ningbo (China). The value proposition of the Valencian enclosure as a green, intelligent and innovative HUB of the Mediterranean has been the common thread of the presentation of the PAV in this forum. Advantages of Valenciaport as a strategic port Mar Chao has also described the strategic importance of Valenciaport for the Chinese market During the event, Mar Chao, President of the PAV, had the opportunity to present the competitive advantages of Valenciaport as a strategic port in the center of the Mediterranean (through which 40% of Spanish import/export is channeled) at the service of the business fabric of its area of influence and a link in the logistics chain. Mar Chao has also described the strategic importance of Valenciaport for the Chinese market as a key point of direct connection with Europe that promotes a green growth, market-oriented, with maximum efficiency in services and a complete logistic and multimodal integration. Commercial capacity of Valenciaport During her conference, the President also highlighted the commercial capacity of Valenciaport, with an area of influence of more than 2,000 kilometres that maintains a direct relationship with the main international ports. Cristina Rodríguez, Head of Containers of Valenciaport, accompanies Chao in the forum. Both have held business meetings with Asian companies and institutions, including the new president of the Port of Ningbo, Tao Chengbo. In the framework of this meeting, the representatives of Valenciaport and the Port of Ningbo have signed a memorandum of understanding (MOU) with the aim of strengthening their commercial collaboration. Silk Road Port and Maritime Cooperation Forum The Silk Road Port and Maritime Cooperation Forum of Ningbo (China) in which Valenciaport participates is a platform for open exchange and mutual learning in port development and maritime transport, within the framework of the Belt and Road Initiative. From a respect for the uniqueness of each participating port, the Forum is seen as a tool to foster collaboration in various fields to build bridges between supply and demand in business, investment, technology, talent, information, ports and cultural exchange.

Bennett Marine, a Division of Yamaha Marine Systems Company, needed a solution that integrated solar energy generation and mechanical upgrades to optimise both sustainability and working environment outcomes. However, adding the cooling capacity needed by a large warehouse, and the employees working there, during the long Floridian summers could significantly increase the utility load on the building. Solution Bennett Marine’s management approached its outsourced service provider, ABM. Having successfully completed two lighting upgrades on site, and acting as the current janitorial service provider, ABM took Bennet Marine’s request to its Infrastructure Solutions team. ABM’s Infrastructure Solutions designed an energy-efficient HVAC system supported by a rooftop solar PV array that offset utility costs with renewable energy, leading to a net 58% reduction in total utility usage for the building. ABM also assisted in securing tax credits and energy incentives for the project, as well as a new roof for the facility with additional building envelope improvements. Finding a better solution for the client ABM provides a consultative approach to help clients achieve sustainability goals, enable capital improvements" “Service experts across our company worked together to solve a need and deliver the sustainability solution Bennett Marine needed,” said Mark Hawkinson, President of ABM Technical Solutions. He adds, “ABM provides a consultative approach to help clients achieve sustainability goals, enable capital improvements, improve indoor air quality, address waste and inefficiency, and create a positive impact for communities.” In addition to the new roof, net energy offset, and improved cooling, ABM was able to assist the project in receiving an estimated $226,000 in tax credits and $224,000 in Energy Incentives through the Federal MACRS (Modified Accelerated Cost Recovery System). Benefits ABM’s Infrastructure Solutions enable businesses to invest in critical infrastructure needs and achieve sustainability, security, and resilience goals. A custom energy program drives costs out of operating budgets and redirects savings to critical needs, helping fund improvements. Highlights of the project for the Deerfield, Florida, warehouse include: Projected energy cost savings in the first year of $12,701 Replacement of ageing roof and speed roll doors to reduce energy loss Solar panel installation is capable of offsetting 66% of the building’s utility use

Korea Marine Transport Company Ship Management (KMTC SM) has reported annual fuel savings worth approximately US$540,000 in total after installing Accelleron’s digital engine optimisation solution Tekomar XPERT on 12 Panamax vessels. The fuel savings enabled KMTC SM to reduce its CO2 emissions by about 4,200 tons. Tekomar XPERT delivers engine optimisation recommendations based on thermodynamic insights that aim to bring engines back to the operating performance achieved at “new” conditions. The solution can be applied to any engine and turbocharger make. KMTC SM followed the advisory from Tekomar XPERT, tracked engine performance and benchmarked engines and vessels through Tekomar XPERT’s web portal (Loreka). Carbon Intensity Indicator (CII) ratings The reduced emissions will translate to better CII ratings and lower exposure to carbon pricing KMTC Ship Management General Manager of Environmental Technology, Jin-Seob Lee, said: “Based on the big savings on fuel cost and emission reduction, we aim to install Tekomar XPERT on our remaining 16 self-managed vessels, and will be recommending its installation on 22 other vessels managed by third parties.” Accelleron anticipates that KMTC’s fuel bill will be reduced by around US$1.3 million a year when Tekomar XPERT is deployed across all 50 vessels. The reduced emissions will translate to better Carbon Intensity Indicator (CII) ratings and lower exposure to carbon pricing, including the EU Emissions Trading System, which will apply to shipping from 2024. KMTC SM’s own measurements KMTC SM was able to track improvements in performance thanks to intuitive indicators and actionable insight from Tekomar XPERT. The reduced fuel consumption at the end of the 12-month period highlighted a significant increase in vessel performance over the year. This was verified by KMTC SM’s own measurements. Accelleron Global Head of Sales & Operations, Shailesh Shirsekar, said: “Efficient engines are one of the keys to reducing fuel costs, emissions and carbon price exposure, enabling optimisation without impact on vessel operation. With simple guidance from Tekomar XPERT, ship operators can ensure that the engines are running at their very best, laying the foundation for lower lifecycle costs as well as regulatory compliance.”