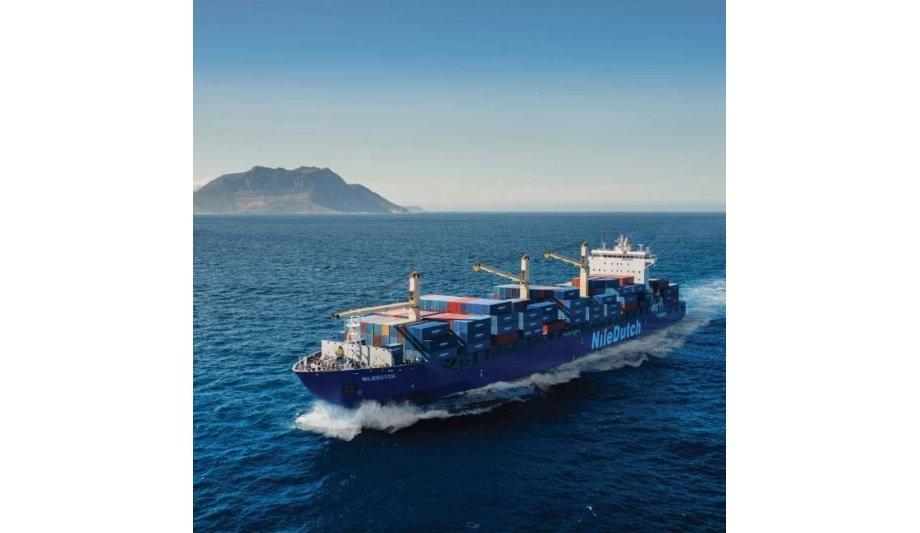

Hapag-Lloyd and NileDutch have signed a sale and purchase agreement where Hapag-Lloyd acquires all shares of the Dutch container shipping company Nile Dutch Investments B.V. (NileDutch). With over 40 years of expertise, NileDutch is one of the providers of container services from and to West Africa.

The company is present in 85 locations across the world and has 16 own offices in the Netherlands, Belgium, France, Singapore, China, Angola, Congo and Cameroon.

Important strategic growth

With 10 liner services, around 35,000 TEU of transport capacity and a container fleet of around 80,000 TEU, the company connects Europe, Asia and Latin America with West and South Africa. Headquartered in Rotterdam, NileDutch has some 350 employees worldwide with particular expertise in the African market.

NileDutch has some 350 employees worldwide with particular expertise in the African market

“Africa is an important strategic growth market for Hapag-Lloyd. The acquisition of NileDutch strengthens our position in West Africa and will be an excellent addition to our existing activities on the continent. Our combined customer base will benefit from a denser network from and to Africa as well as from a much higher frequency of sailings.”

Further developing business

“We welcome the new colleagues from NileDutch and hope that together we can further develop our business in Africa in the years to come,” said Rolf Habben Jansen, CEO of Hapag-Lloyd.

Wim van Aalst, President of NileDutch, added: “Hapag-Lloyd and NileDutch are a very good fit and I am happy that we join forces. Combining our business and expertise in West Africa with Hapag-Lloyd´s worldwide network will enable us to make the next step and further develop the Africa business.”