A near-record backlog of cargo ships in Southern California could have serious ramifications for the US economy.

The build-up of cargo ships carrying key exports from China, including electronics, furniture, and toys, threatens to increase shortages and price hikes in the US ahead of the holiday season. The dozens of hulking cargo ships wait an average of nearly 10 days to dock and unload, according to data from the Port of Los Angeles.

Container vessels

Los Angeles and Long Beach had over 150 ships in port, including 95 cargo ships, the Marine Exchange of Southern California reported. Before the pandemic, the ports handled about 60 to 70 ships at once. Currently, those numbers have more than doubled.

The ports had 62 cargo ships waiting at anchor or in drift areas for a spot to open up to dock and unload, turning the ports into a highly orchestrated parking lot for container vessels that can be valued at over $100 million and weigh in at over 200,000 tonnes.

Ship dock planning

Before the pandemic, the ports typically had zero or one ship waiting to dock, Kip Louttit, the executive director of the Marine Exchange of Southern California, told Insider.

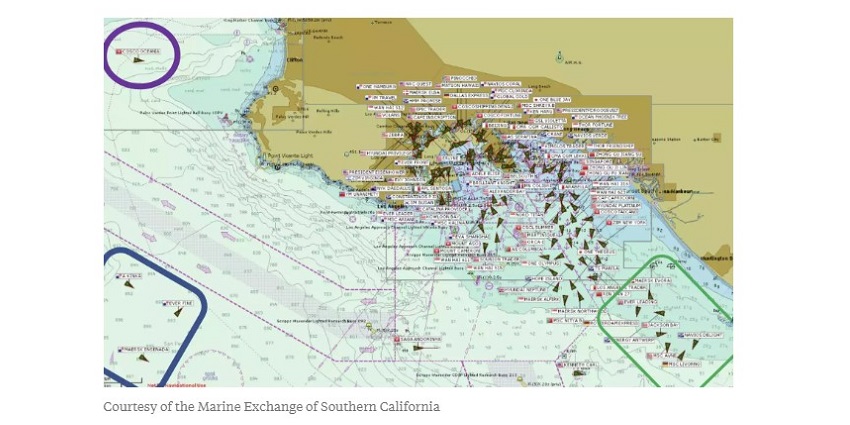

A screenshot from the Marine Exchange of Southern California's dashboard taken recently shows the careful planning that goes into not only where each ship will dock, but also where the cargo ships will be placed at anchor or to drift.

The triangles indicate different ships. The circles and rectangles on the screen show anchorages and drift areas, while the purple hashes designate the shipping lanes for incoming and outgoing vessels.

Impact on supply chain

COVID-19 port shutdowns and labour shortages led to the build-up of boats and continue to add to the congestion

A spike in ordering, COVID-19 port shutdowns, and labour shortages led to the build-up of boats in 2021 and continue to add to the congestion. It has also created a shortage of container ships which has further exacerbated the issue. The compounding effects have impacted all facets of the supply chain from exporting the inventory out of China to ground transportation efforts in the US.

The number of days it takes to transport an item from Asia to its final destination has more than doubled, according to data from Flexport.

Backlogs

Even as transportation timelines continue to lengthen, demand continues to outpace the available supplies. Early on in the pandemic the work-from-home boom and panic-buying frenzy bolstered online sales at a time when ports were combating COVID-19 shutdowns. Currently, backlogs are spiking again as the holiday shopping season looms.

As demand for products and as a result demand for space for cargo ships at ports has spiked, delays have made the space at ports and in cargo ships increasingly more valuable.

Supply chain crisis

Recently, Judah Levine, the head of research at Freightos, told Insider that the price for transporting a 40-foot container between the US and Asia jumped 500% from this time last year to $20,586.

The build-up of ships in the Port of Los Angeles shows no signs of abating in the coming weeks, according to data pulled by Flexport of the container ships scheduled to come into the port. Executives have warned the supply chain crisis will continue into 2023.